US President Donald Trump’s decision to impose 25% tariffs on imports from Mexico and Canada while threatening a 100% tariff on Taiwanese semiconductors is already raising alarms. Although tariffs on Mexico and Canada have been delayed for a month, the damage to trust among U.S. allies will be lasting—and America may suffer the most in the long run.

Trump’s tariff war is shaping up to be a Pyrrhic victory—where any short-term gains come at an unsustainable cost to American industries and allies. This brings to mind the Seven Injuries Fist (七傷拳, Qī Shāng Quán), a high-risk martial arts technique from Chinese martial art fiction. The Seven Injuries Fist is so aggressive that it damages both the opponent and the attacker, making it a dangerous but powerful weapon that may see immediate effect but make the attacker pay the price in the long run.

Trump’s trade war with China already reflects this high-risk strategy, but his decision to impose higher tariffs on allies than on adversaries has drawn sharp criticism. Wall Street Journal labeled it as an economically counterproductive trade war, saying that it makes no sense to levy 25% border tax on Canada and Mexico while China, the real adversary, only needs to endure 10%. Penalizing allies while being more lenient on adversaries has triggered anger and calls to reduce dependence on America. Ontario has announced American companies will be banned from provincial government contracts until the US ends the tariffs President Donald Trump imposed on Canada. Premier Doug Ford also said he is "ripping up" a C $100M ($68M) contract with Elon Musk's satellite Internet company Starlink.

As the saying goes, "Be careful what you wish for." Let’s take a closer look at what Trump’s tariff wish list might actually deliver.

1. American Auto industry in the Crosshairs

Donald Trump told American people they are going to “feel some pain”. He was probably referring to inflation. However, there are consequences at a larger scope that his administration did not see. WSJ took the auto industry as an example that American car makers must import components and have the half-finished products assembled and integrated across the border a dozen times to optimize efficiency. With 25% tariffs imposed, American car makers will lose their advantage from the Free-Trade Agreement that the U.S. signed with Mexico and Canada, making European, Japanese or Korean cars more attractive instead.

2. Who will bear the most pain?

Experts warn that if Trump’s tariff policy targets U.S. allies, it will hurt Americans more than anyone else. After all, the U.S. can’t be great again without its friends.

Does Trump really want to push allies away—the same allies he’ll need to safeguard America’s national security?

“If inflicting the Seven Injury Fist on enemies is making China feel 100% of the pain and America itself 70%, then doing that on allies would be America 100% while the allies 70%,” said Nobunaga Chai, a Taiwan-based senior semiconductor analyst and Vice President of Cloud Express, which is affiliated with Taiwan’s Legislature.

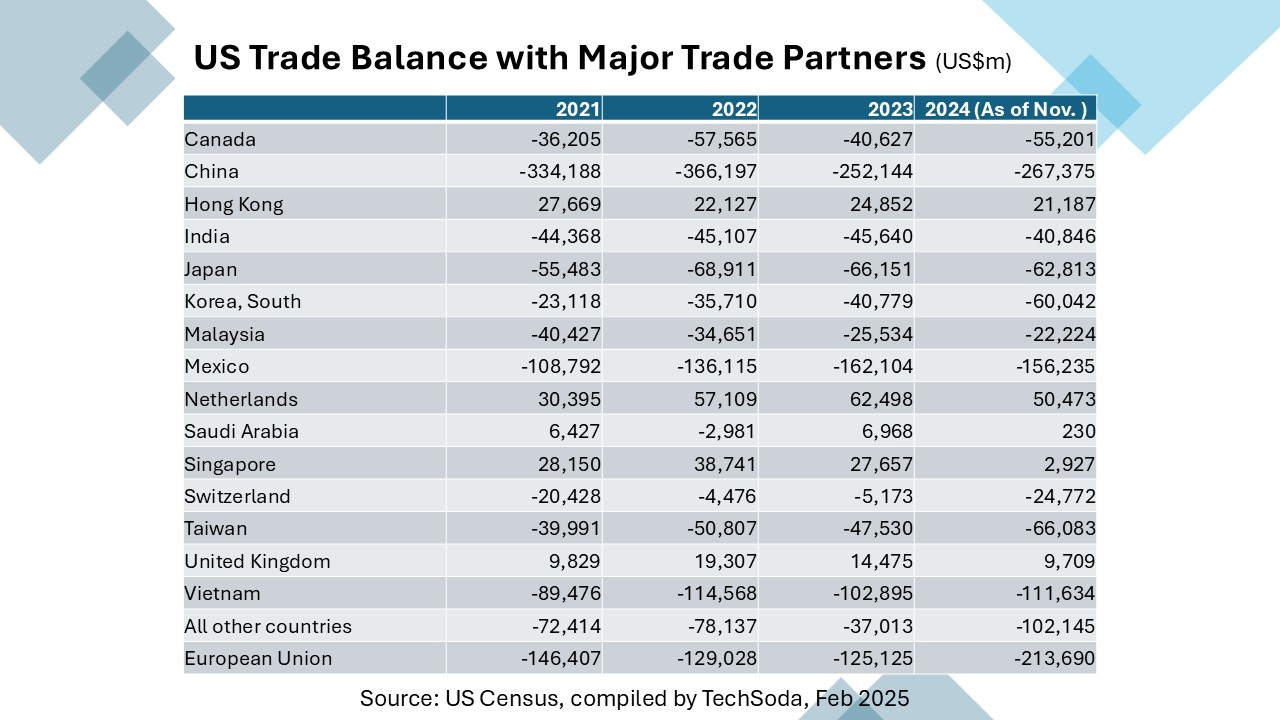

The Consensus Bureau statistics showed that the the US’s trade deficit with almost all of its major trade partners, including China, is hitting new highs year-to-date (Nov 2024) is. This only explains why the tariffs didn’t work, as the Biden Administration hardly changed the tariff levels that Trump implemented in his first term.

If they retaliate and refuse to buy American exports, demand will decrease while supplies increase. Since American companies cannot profit from this, job cuts will occur. Meanwhile, will American consumers buy up the unsold exports? I will leave that to American readers to answer.

3. Tariffs to Push Chips Further Away

Imposing 100% tariffs on all chips from Taiwan is widely seen as a tactic to pressure Taiwan and TSMC into negotiations. But what is Trump’s true goal?

A. To boost domestic chip manufacturing?

TSMC is already building the second and the third fabs in the U.S. It takes at least 2 years to build a fab and another year to fine tune the equipment for mass production. Since the costs of building the fabs and running the operations in Arizona is much higher than that in Taiwan, the American customers who want all of their products to be made in America will have to shoulder most of the tariffs and the extra costs but even so they cannot get the capacity until the new fabs are ready. A 2019 study showed that the U.S. manufacturing industries facing higher tariffs tend to lose jobs, as the benefits of import protection are outweighed by higher input costs and retaliatory tariffs, according to US think tank Information Technology and Innovation Foundation (ITIF). Therefore, tariffs are counterproductive if Trump’s goal is to create jobs, not eliminate them.

B. To undermine Taiwan’s semiconductor dominance?

But Taiwan isn’t a competitor—it’s a key partner to American giants like Intel, AMD, Apple, Tesla, Nvidia, Qualcomm, TI, and Broadcom, etc. Despite its importance, Taiwan’s dominance in chipmaking has led some in Washington to push for more domestic production.

These fabless companies account for approximately 65% of global demand for semiconductor manufacturing, according to US think tank Information Technology and Innovation Foundation (ITIF). Their costs would go up, and that may drive them to avoid tariffs by moving production elsewhere – such as TSMC’s second fab in Kumamoto Japan.

The most likely scenario: 100% tariffs for chips to be sold in American market and end up getting less than expected

Ironically, instead of helping U.S. semiconductor firms, these tariffs may accelerate shifts in production elsewhere—potentially benefiting Japan or even China.

“Instead of moving production sites back to America, they are more likely to set up regional logistic centers to receive the chips manufactured and packaged and verify their quantities and qualities there before shipping them to customers in countries outside the United States,” said Chai. Up till now, all chips have been shipped to the headquarters and therefore will be susceptible to tariffs. Trump’s 100% tariff will immediately drive the goods for other countries away and lose that part of the international trade. Let’s not forget, it is much easier to build a regional logistic center than fabs.

If Taiwanese semiconductor firms struggle or fail, how does that benefit the U.S.? Will that help Intel or Global Foundries to get TSMC’s global market share in advanced chips which are vital for smartphones, AI servers and PCs, high-performance computing (HPC), and autonomous cars and robots? If the American manufacturers cannot catch up fast enough, tech products that rely on Taiwanese chips—like smartphones, laptops, and gaming consoles—could see price hikes or supply shortages.

“Not only American companies including Apple, Nvidia, and Tesla, which have been working closely with TSMC will bear the brunt, those who co-develop chips with TSMC, such as Google and Amazon will also be impacted,” said Chai.

“We would view relatively more risk to the PC and Apple supply chain and relative protection from AI and advanced foundry, advanced packaging and DRAM if we see targeted tariffs that impact tech consumption and relatively less risk on Gen AI cloud investments barring full blown trade war driving a global recession,” said Randy Abrams, Head of Taiwan Research, UBS Investment Bank in a recent note commenting Trump’s tariff policy.

Unexpected Implication on Legacy Chips

For legacy chipmakers like UMC, PSMC, and Vanguard International, 100% tariffs could mean losing U.S. market share—not to American firms like GlobalFoundries (GF) but to Chinese competitors, who would only face a 10% tariff. Even if Trump adds up the 60% tariff he threatened to impose on Chinese products, Chinese chip makers still have a 30% advantage over Taiwanese rivals.

As discussed in a previous article, legacy chipmakers outside China are already struggling due to thin margins and aggressive price cuts from Chinese rivals. Unlike advanced chip players, they can’t afford to build new fabs in the U.S. or absorb the costs of operating there. Tariffs on Taiwan would be a gift to China, allowing its state-subsidized chipmakers to dominate a market that the U.S. itself handed over.

Is that the outcome Trump wants? If so, Trump is helping the Chinese semiconductor industry to thrive.

History’s Warning: A Repeat of Smoot-Hawley?

For the first time in history, TSMC will hold its board meeting in the U.S. next week—just as Trump plans to announce tariffs on Taiwan on February 18. The timing is no coincidence; the pressure is unmistakable. Speculation is growing: What is the U.S. really pushing TSMC to do? What deals—or ultimatums—might come from this meeting?

Trump’s approach to bringing chip manufacturing back to America resembles the North Wind in Aesop’s fable—forceful and punishing—while Biden’s CHIPS Act is like the Sun, using incentives and cooperation. Which method actually works?

History offers a warning. The last time America weaponized tariffs this way, it was the 1930 Smoot-Hawley Tariff Act—a policy that failed to reduce the trade deficit and crippled the economy instead. Retaliatory tariffs from trading partners slashed U.S. exports and imports by 67%, deepening the Great Depression.

Will Trump’s tariffs repeat this historic mistake? If so, America may once again pay the price.

Reference

https://www.wsj.com/opinion/donald-trump-tariffs-25-percent-mexico-canada-trade-economy-84476fb2

https://www.japantimes.co.jp/business/2025/02/03/economy/trump-trade-war-mexico-canada-china/

https://en.wikipedia.org/wiki/Smoot%E2%80%93Hawley_Tariff_Act

Why is Trump threatening allies with high tariffs but is soft on China? One possibility, suggested by the economist Paul

Krugman, is that these tariffs are not in the national interest but in rhe personal interests of the people calling the shots. Let’s not forget, Elon Musk has broad business interests in China and therefore an incentive not to jeopardize relationships with china’s leaders. Though there is no direct evidence, this explanation for these counter intuitive tariffs is plausible.

Thank you!