Chip Wars Escalate: Can US Counter China's Legacy Semiconductor Surge with Section 301 Investigation?

The Section 301 investigation announced by US Trade Representative Katherine Tai just before Christmas will take at least a year to issue final rulings and implement measures to protect the interests of American and allied semiconductor companies. However, by the time rulings are finalized, many legacy chip manufacturers, as well as smaller standard memory products and wafer producers, may already face significant losses or even be pushed out of business as Chinese competitors seize market share.

A Battlefield with No Hostages

In a previous commentary following the Biden Administration’s tightening of export restrictions on semiconductor manufacturing equipment and high-bandwidth memory (HBM), TechSoda warned that the escalating Chip War between the US and China is taking a brutal toll. China, meanwhile, has been quietly fortifying its position through aggressive expansions in mature node chips, memory products, and base substrates, alongside significant improvements in quality.

Chinese suppliers like Shanghai Silicon Industry and TCL Zhonghuan are undercutting competitors, offering test wafers at prices 30% lower than Taiwan’s average, according to Taiwan’s Economic Daily. This price war threatens established players such as GlobalWafers, PSI, Kinik, and Formosa Sumco.

Beijing’s Subsidies Fuel Expansion

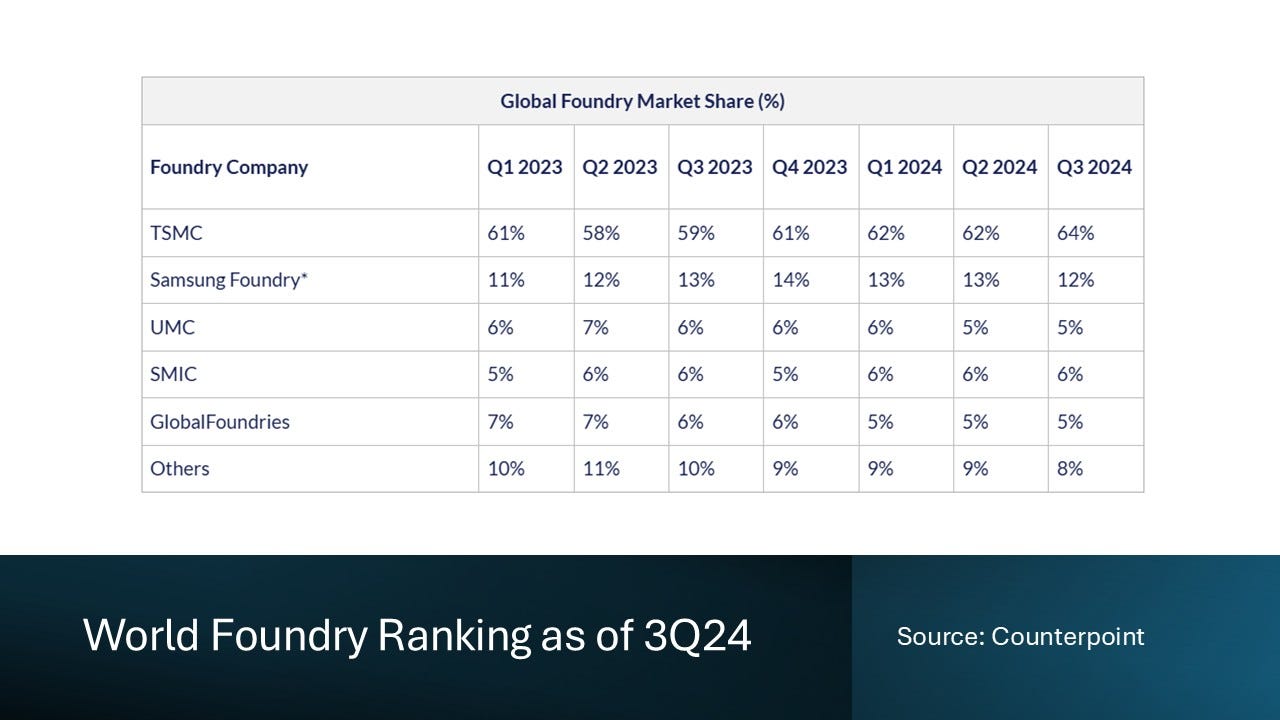

China’s Semiconductor Manufacturing International Corp (SMIC) has surpassed Taiwan’s United Microelectronics Corp (UMC) and GlobalFoundries to become the world’s third-largest foundry, trailing only TSMC and Samsung. This growth is largely driven by generous subsidies and policies aimed at self-sufficiency, steering domestic demand toward local suppliers.

Competition in mature process nodes is fierce. Among these, the 28nm node stands out as a critical point in the realm of mature processes. In the fiercely competitive chip foundry market, the rivalry between players resembles an invisible war.

TSMC and UMC, the two leading chip foundry giants, have long maintained a relatively high price level for 28nm process foundry services, with prices consistently above $5,000 per wafer. However, SMIC took the lead by implementing a “killer strategy” for mature process products such as MCUs and power management ICs, slashing the 28nm process foundry price from $2,500 per wafer to $1,500, according to Semi Vision, a semiconductor research startup.

Semi Vision’s analysts also observed that by improving its HKMG (High-K Metal Gate) process technology, SMIC enhanced production efficiency and product performance, effectively reducing unit costs. According to the latest data from IC Insights, China’s share in the global 28nm-65nm process market surged from 18% in 2020 to 31.5% in 2023.

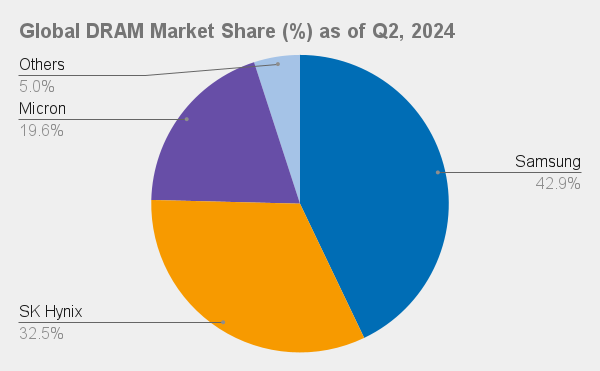

Memory: A Neglected Front

DRAM is another arena where China is emerging as a formidable player. Hefei Chang Xin Memory Technology (CXMT), the country’s leading memory producer, has made rapid gains. Its global DRAM market share, less than 2% three years ago, is expected to reach 10% this year and 15% by 2025, according to Silicon Motion Technology Corp CEO Wallace Kou. CXMT’s advancements in technology and production capabilities have placed significant pressure on established giants like Samsung, SK Hynix, and Micron.

CXMT has also begun small-scale DDR5 production and plans to ramp up shipments of LPDDR5 by mid-2025.

DDR5 offers four times the data capacity and double the processing speed of its predecessor, DDR4, and is widely used in desktops and large-scale servers. It is considered a high-value product alongside high-bandwidth memory (HBM) in the AI era, according to Korean media Chosun Daily.

This growth has hurt smaller players, including Japan’s Kioxia (which produces Oxide-Semiconductor Channel Transistor DRAM) and Taiwan’s Winbond and Nanya Technology, which have seen their net values halved amid intense competition.

Why CXMT Is Surging

CXMT’s rise can be attributed to its exclusion from the US Entity List, allowing it access to critical manufacturing equipment. Coupled with Chinese government subsidies, the company has stockpiled mature-node semiconductor tools and materials, driving production growth. By contrast, YMTC, another Chinese memory producer under US sanctions, struggles with a market share below 4%.

CXMT isn’t stopping at legacy DRAMs. Reports indicate that it is progressing in developing HBM chips for AI server GPUs and plans to collaborate with domestic players like Huawei to produce HBM2 chips by 2026. However, some argue that US efforts to curb China’s advancements in advanced memory chips may already be too late, as Chinese manufacturers have secured the necessary equipment.

The Importance of Legacy Chips

While the US has focused its Chip War defensives on advanced semiconductors, it has paid insufficient attention to legacy chips, manufactured using mature-node processes (10-22 nm and above). Legacy chips are foundational to modern economies, powering home appliances, automobiles, networking equipment, and even defense systems.

Andreas Schumacher of CSIS emphasizes that overcapacity may not be the core issue but rather the West’s over-reliance on the Chinese market and China’s non-market practices. He calls for greater US government preparedness and policy action to address these challenges.

Overcapacity and Geopolitical Risks

China’s push for self-sufficiency in semiconductors includes building excess capacity, some of which may not even be operationally viable but still serves to undercut competitors. In addition, China’s weaponization of the West’s dependency on its rare metal elements and depriving legitimacy of American chips as “unsafe” has raised alarms within the Semiconductor Industry Association (SIA), which has urged US policymakers to:

Collaborate with industry stakeholders.

Strengthen domestic chip manufacturing, research, and design capabilities.

Promote demand for US-made chips both domestically and internationally.

A recent BIS report highlights significant visibility issues in US supply chains reliant on mature-node chips, with many companies unable to trace their origins. Despite this, over two-thirds of US products contain chips from China.

Action Required

To reduce reliance on China, the US and its allies must:

Identify alternative sources for mature-node chips, substrates, and memory products.

Ensure that CHIPS Act funding secures supply chain resilience.

Meanwhile, since the new administration might reverse policies on clean energy and electric vehicles, the demand for silicon carbide substrates—Wolfspeed’s primary product—is likely to wane. In contrast, China’s appetite for this material, used in automotive and power chips, continues to grow due to its massive market. If Wolfspeed cannot withstand the cutthroat competition, CHIPS Act investments may be squandered.

However, China’s disorderly expansions in areas like automotive silicon carbide production and mature process chips have made the situation more challenging. Experts warn that the US’s response may be too late, as China’s mature process chips could account for 40% of global supply by 2032, with dominance in applications like home appliances, telecommunications, and defense.

The Future of the Chip War

Legacy chips such as driver ICs, MCUs, and RF chips remain critical to industries spanning IoT, telecom, and automotive. The global semiconductor landscape is at a crossroads. As China aggressively builds its self-sufficient semiconductor industry, supported by subsidies and policies favoring local suppliers, and weaponizes the West’s dependency on its market, the US and its allies must act swiftly to safeguard their technological and economic interests.

Policymakers must prioritize supply chain resilience, incentivize domestic manufacturing, and forge international collaborations to reduce dependence on China. The question remains: Can the US and its allies match the pace of China's expansion and secure a sustainable semiconductor future?

Referenced sources:

US-China Chip War Heats Up, Nvidia Probed, What’s Next?

https://techsoda.substack.com/p/us-china-chip-war-heats-up-nvidia

合肥長鑫明年中大量生產LPDDR5 業界估不利DRAM價格走勢

https://news.cnyes.com/news/id/5818805

Chinese firms make headway in producing high bandwidth memory for AI chipsets

China’s Mature Semiconductor Overcapacity: Does It Exist and Does It Matter?

USTR Initiates Section 301 Investigation on China’s Acts, Policies, and Practices Related to Targeting of the Semiconductor Industry for Dominance

美國狙擊中國成熟製程,台系半導體二線廠得以喘口氣

SIA Statement

This is one of my favorite pieces of yours I've ever read. You make a lot of insightful points.