Is the West Listening to Huawei’s Silent Lesson in Tech Diffusion?

The U.S. and China spar over semiconductors and AI, redefining what truly makes a tech superpower.

The intensifying tech rivalry between the United States and China continues to evolve, driven by U.S. export controls on advanced semiconductors and potential tariffs on allies. These measures have triggered a wave of strategic responses and differing assessments from both nations. Recent developments—such as renewed scrutiny of Huawei—highlight the shifting landscape, as analysts weigh the economic implications for global players like NVIDIA and examine China's accelerating push for technological self-reliance and widespread innovation.

At a recent forum in Taipei, experts emphasized the need to establish a “T7” alliance—a coalition of democratic nations working together to secure a resilient and values-based semiconductor supply chain. While safeguarding advanced technologies from potential military misuse by China remains a priority, allies must also recognize the vital role of technology diffusion. Innovation flourishes not in isolation, but within ecosystems driven by strong, diverse demand. Ignoring this balance could risk undermining the very competitiveness such alliances seek to protect.

The Impact of U.S. Sanctions: Unintended Consequences and Strategic Considerations

Since 2019, the U.S. has implemented export controls primarily aimed at slowing China's technological and military advancements by limiting access to advanced semiconductor chips and the sophisticated equipment needed to produce them. However, the effectiveness of these measures and their potential for unintended consequences remain key points of discussion among U.S. officials.

David Sachs, a prominent venture capitalist and Trump advisor, suggests that China has become "quite adept" at developing alternatives or bypassing Washington's export controls. He estimates China's semiconductor design capabilities are at most only two years behind the U.S., a tighter gap than many might assume. Sachs cited DeepSeek's breakthrough AI model as evidence of China's continued progress, noting that their AI models are now merely "a few months behind" Western counterparts. He issued a significant warning: overly strict sales restrictions on AI chips, particularly impacting U.S. allies, could inadvertently empower Chinese companies like Huawei by creating market vacuums that were previously dominated by American firms. This highlights a crucial strategic consideration for the U.S. in avoiding outcomes that accelerate competitor growth.

In contrast, Jeffrey Kessler, who is nominated by Trump to head the U.S. Commerce Department's Bureau of Industry and Security (BIS), responsible for enforcing these controls, offers a more cautious outlook on China's current chip production capacity. He estimates Huawei will likely produce a maximum of 200,000 advanced AI chips in 2025, primarily for its domestic market—a relatively modest volume compared to global demand. However, Kessler also warns against a "false sense of security," emphasizing China's rapid trajectory and clear ambition for the global market. It's important to clarify that while China's AI models are indeed closing the gap rapidly, their actual AI chip production capacity is still estimated to be one to two years behind the U.S.

NVIDIA Navigates the Evolving Market Landscape

Global tech giants find themselves in a challenging position, adapting to these geopolitical tensions. NVIDIA, a key player in the chip competition, has experienced a direct financial impact from the export controls. The H20 export ban, targeting NVIDIA's AI accelerator chips for data centers, effectively curtailed their high-end data center business in China. This resulted in a significant 10 percentage point drop in NVIDIA's first-quarter gross profit, amounting to an estimated $15 billion loss of sales for the first half of the year alone.

This scenario has prompted NVIDIA to fundamentally re-evaluate its market strategy. The company has informed investors that future revenue and profit projections will now exclude the portion of their Chinese business impacted by restrictions. Projections indicate NVIDIA's market share in China's AI market could shift significantly, potentially falling from 95% just four years ago to below 50%, with further declines possible as regulations tighten. NVIDIA CEO Jensen Huang explicitly acknowledged that these restrictions are "inadvertently stimulating innovation and scaling within China," presenting a strategic challenge for the U.S. to maintain its market leadership. He stressed that "China's AI will continue to develop whether or not it has American chips," underscoring the inevitability of indigenous development.

Huawei's Resilient Strategy: "Mathematics to Make Up for Physics"

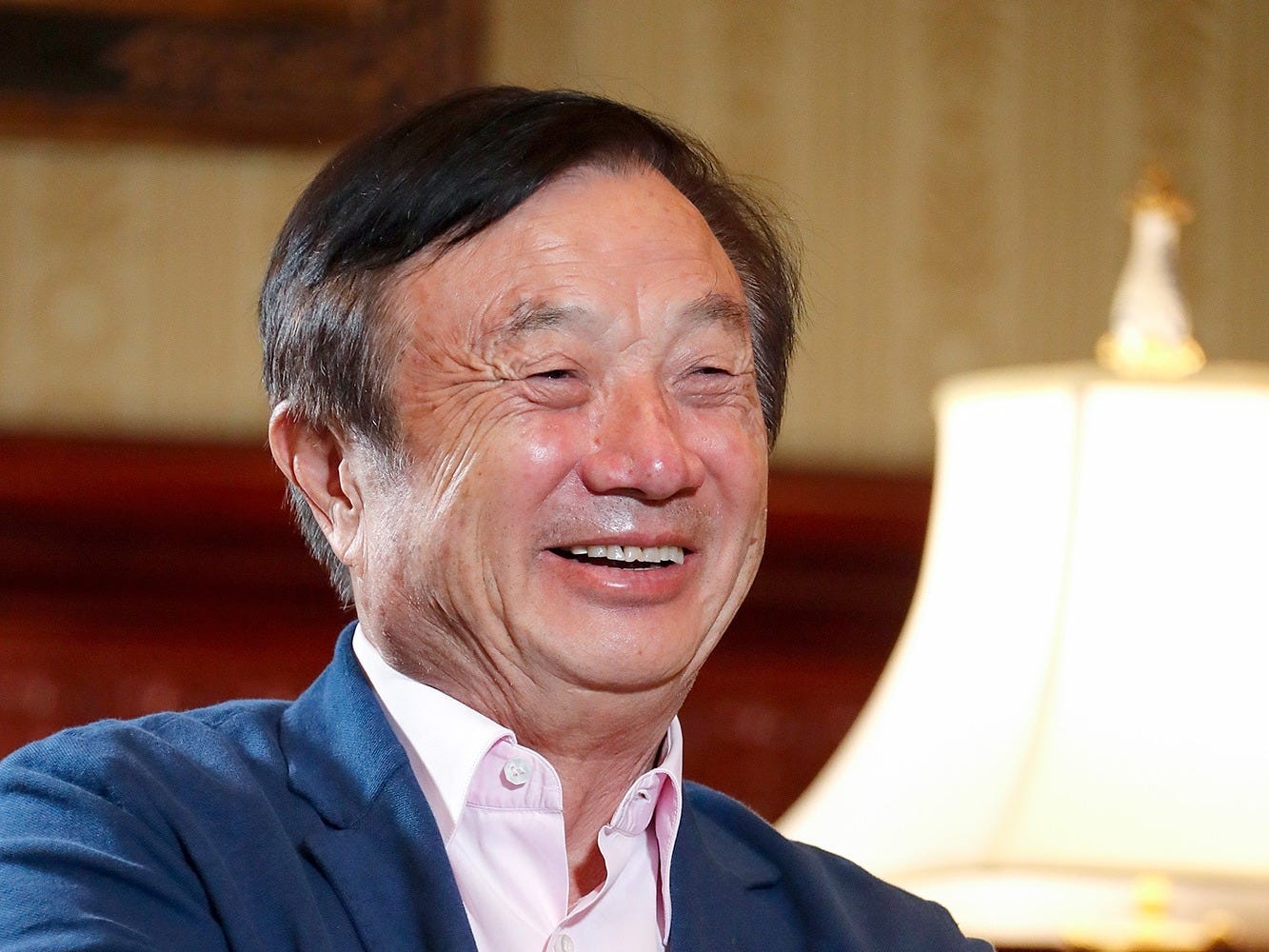

On the Chinese side, Huawei's chairman, Ren Zhengfei, has presented a defiant and long-term perspective in a rare public interview. His core message conveys "profound determination": "Don't think about difficulties, just get it done, move forward step by step." He views challenges not as temporary obstacles, but as a constant and inherent part of progress.

Ren acknowledged that Huawei's single-chip technology is "one generation behind the U.S." and even admitted that America has "overstated Huawei's achievements." Despite this, he highlighted their innovative approach to compensate: "They use mathematics to make up for physics," referring to non-Moore's Law strategies and cluster computing to achieve practical functionality despite limitations in raw chip power. This involves exploring novel chip architectures, highly optimized software, and leveraging parallel processing across many simpler chips to achieve comparable computational results for specific tasks.

Huawei places immense emphasis on foundational work and basic research. Ren revealed that approximately CNY60 billion of their CNY180 billion annual R&D budget is allocated to basic foundational research, notably with "no assessment or immediate performance pressure." He stressed the need for strategic patience, recognizing that basic research often takes decades or centuries to yield visible contributions. He also mentioned Huawei's non-profit online platform, Chaspark, which provides free access to global scientific information, fostering collaboration without pushing for results.

Ren Zhengfei also articulated China's unique perceived advantages for AI development within its socialist market economy. He believes China's ability to undertake massive infrastructure projects (high-speed rail, advanced power grids, communication networks) provides a crucial foundation for industrial and agricultural modernization. He views AI as potentially "human society's last technological revolution" alongside nuclear fusion, with China benefiting from a large population, robust electricity infrastructure, the world's most developed communication network, and rapid application of AI in manufacturing. He reiterated their ability to overcome chip challenges through "superposition and clustering" and anticipates a future with "hundreds or thousands of open-source software solutions." He asserted that China's increasing openness will "break through all blockades and achieve great rejuvenation."

Diffusion Theory: A Framework for Understanding National Technological Strength

Jeffrey Ding's book, "Technology and the Rise of Great Powers", offers a unique perspective on the US-China tech competition. Ding argues that technological revolutions affect global power dynamics not solely based on who achieves a major invention first, but rather on which states are most successful at adapting and embracing new technologies at scale. This shifts the focus from initial invention to widespread "diffusion" and effective implementation.

Ding's theory emphasizes "institutional adaptations"—how effectively a country adjusts its government, industry, and education systems to integrate technological advances throughout its entire economy. Historical examples, such as Britain's rise in the first Industrial Revolution through steam power diffusion, and America and Germany surpassing Britain in the second through widespread adoption of electricity and the internal combustion engine, illustrate this principle.

Applying this to the current U.S.-China AI competition, Ding's work suggests that long-term success may not be determined solely by who creates the "cleverest algorithm" or "most powerful chip" first. Instead, it will likely hinge on which nation can most effectively integrate and scale these technologies across its entire economy, from advanced manufacturing to basic research and broad societal applications.

From this perspective, the U.S. should view Huawei's advancements and China's focus on diffusion with a strategic understanding rather than a simplistic interpretation of "winning" or "losing." While China's rapid adaptation and application of existing technologies are significant, the U.S. still holds considerable advantages in foundational innovation and cutting-edge research. The challenge for the U.S. is to continue fostering pioneering breakthroughs while simultaneously ensuring robust diffusion of these technologies across its own economy, leveraging its inherent strengths.

The US will need to build a diverse ecosystem with multiple industries and supply chains that support each other to make its effort in reshoring sustainable. This is exactly how China succeeded in becoming a manufacturing superpower, as Kyle Chan, an American postdoctoral researcher in the Sociology Department at Princeton University, has described in his article.

Wolfspeed: A Case Study in Failed Tech Diffusion

Yet, when viewed through the lens of technology diffusion theory, one is left to question why the cautionary tale of Wolfspeed has not yet served as a wake-up call for policymakers.

Wolfspeed, a U.S.-based supplier of silicon carbide (SiC) substrates, is a victim of the institution’s failure to foster an ecosystem for tech diffusion. Wolfspeed used to be the market leader of SiC substrates, but Chinese competitors caught up due to the wide application and robust demand for the product in China’s EV market.

Wolfspeed is reportedly near a bankruptcy deal despite receiving CHIPS Act subsidies. In our previous article, we reminded our readers that if U.S. policies on clean energy and EVs are reversed, Wolfspeed could lose its domestic market support, leaving it vulnerable to China’s cost advantages and the CHIPS Act subsidy squandered.

The unfolding U.S.-China tech rivalry, therefore, prompts a crucial question: In an era of constant technological evolution, what truly defines a nation's enduring technological strength? Is it primarily control over initial innovation and the cutting edge, or the widespread ability to integrate and adapt new technologies deep into the fabric of its society? The answer, and the strategic path forward for each nation, will likely involve a dynamic interplay of both.