Watch Out For the Reciprocal Tariff Boomerang: Who Gets Hit First?

Tariff Rates Were Mis-calculated? Trade Deficits are What Trump is After

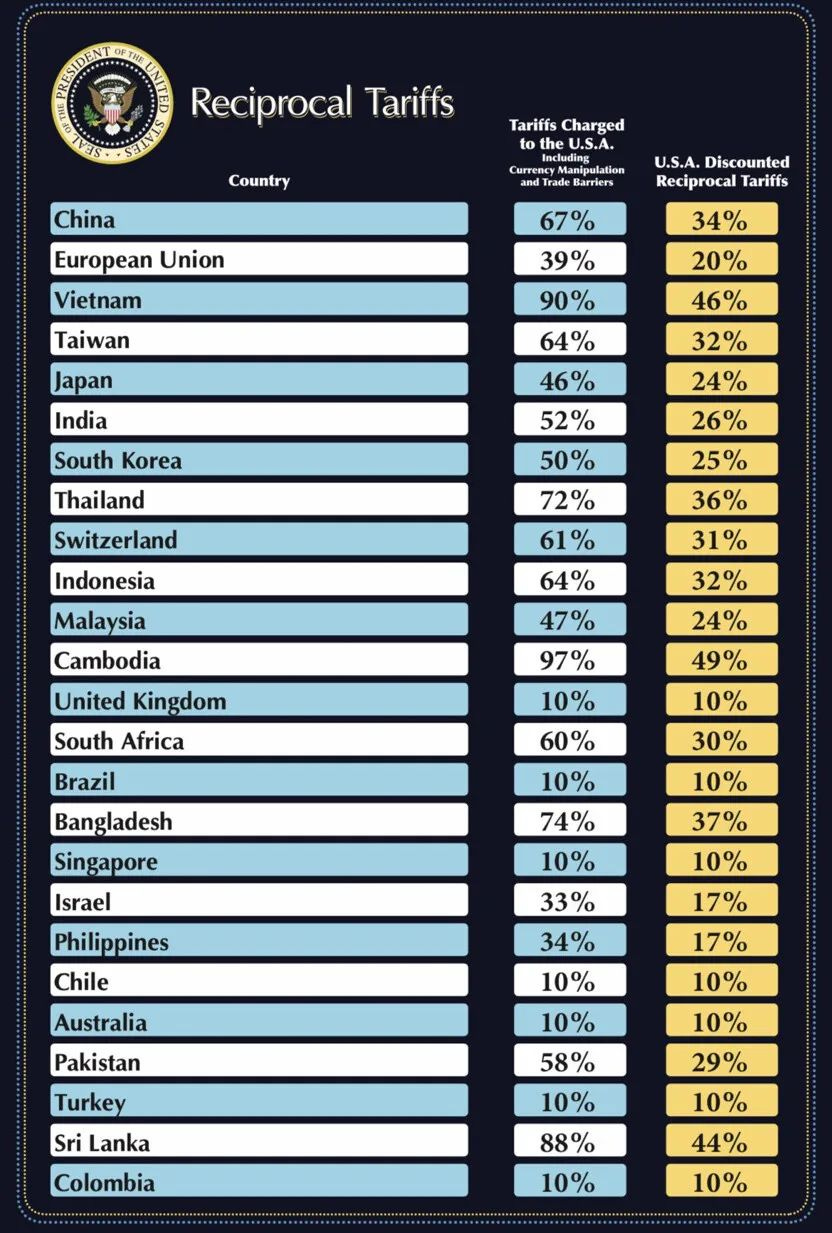

US President Donald Trump announced his “Liberation Day” reciprocal tariffs on April 2, sending shockwaves across the globe, particularly among U.S. allies. The blanket tariff rates, however, are expected to immediately impact American companies and their supply chain partners.

The potential for a "boomerang effect" is particularly concerning, where the tariffs intended to protect domestic industries might backfire, harming the very sectors they aim to shield. This could result in higher consumer prices, disrupted supply chains, and strained international relations. As businesses brace for these changes, the risk of unintended consequences looms large, prompting calls for careful reconsideration of these trade policies.

Many supply chain partners of U.S.-based tech giants such as Nvidia, Apple, Dell, HP, Microsoft, and Google have already relocated production lines from China to alternative locations in Southeast Asia, India, and Mexico. Yet, with Vietnam, Thailand, Indonesia, and India now facing high tariffs under the new policy—and with factories in the United States still under construction and struggling to secure sufficient labor—the burden of these measures will fall heavily on these companies.

In this article, we examine the methodology behind calculating reciprocal tariffs and highlight additional risks and possible approaches that companies should consider.

Taiwan’s cabinet expressed regret over the "unreasonable" tariffs in a formal statement. It emphasized that Taiwan's increased exports to the U.S., driven by demand for semiconductors and AI-related products as well as Trump's earlier tariffs on China, should not be penalized. The Executive Yuan pledged to engage in diplomatic negotiations to address the issue.

The Chinese National Association of Industry and Commerce (CNAIC) in Taiwan warned that the 32% reciprocal tariffs would severely impact Taiwanese supply chains. It called for immediate crisis response measures by the Taiwan government and urged comprehensive impact assessments while advocating for dialogue with the U.S. to reduce tariffs and provide financial support to affected industries.

While Taiwan’s stock market remains closed for spring holidays, U.S. stock indices futures are already reacting negatively. Nasdaq and S&P 500 futures both plunged more than 3.5% in pre-market trading.

The Formula Behind the Tariffs

The Trump administration’s tariff formula has raised eyebrows among economists. According to Hsu Wen-tai, Adjunct Professor at National Taiwan University’s Department of Economics, the formula revealed by the United States Trade Representative (USTR) calculates tariffs based on trade surplus using the equation:

Reciprocal Tariff = (Export - Import) / Import×ε×ϕ

Here, ϕ represents tariff passthrough to import prices (ϕ>0), while ε is the elasticity of imports with respect to price (ε<0). However, Hsu criticized this approach for failing to account for diverse trade elasticities and passthrough rates across different products and countries.

The reliance on single-year trade data from 2024 further undermines the formula’s accuracy. Hsu argued that applying a uniform 32% tariff across non-semiconductor sectors would disproportionately harm Taiwan's economy, especially industries already grappling with overcapacity competition from China. He also noted that Taiwan’s average tariffs on U.S. goods remain below 3%, making the reciprocal tariff argument baseless.

Over-simplifying Trade Dynamics

President Trump's reciprocal tariffs—matching the tariffs that other countries impose on U.S. goods—have raised significant concerns among economists and trade experts. The methodology for calculating these tariffs involves dividing a country's trade deficit with the U.S. by its exports to the U.S., halving the result, and applying a minimum tariff of 10%. Critics argue that this approach oversimplifies complex trade dynamics and may disproportionately affect emerging markets.

There are also apprehensions that the revenue generated from these tariffs is being viewed as a potential substitute for federal income tax collections. However, experts note that tariffs alone are insufficient to replace income taxes, given the vast difference in revenue scales. For instance, in fiscal year 2023, individual income taxes contributed approximately $2.2 trillion, while tariffs accounted for about $80 billion. Attempting to bridge this gap through tariffs would require unrealistically high rates and could lead to reduced imports and economic inefficiencies.

Strategic Adjustments by Tech Firms

Trump’s tariff policies have forced tech companies like Apple to reconsider their strategies. Despite pledging $500 billion for U.S.-based production facilities, Apple still faces steep import tariffs on devices assembled in Vietnam (46%), Indonesia (32%), China (10% + 10% + 34%), Thailand (36%), and India (26%). Luke Lin, a senior tech analyst, highlighted additional risks from secondary tariffs tied to crude oil imports from Venezuela—a factor affecting countries like China, Vietnam, and India.

Acer has already announced a 10% price hike for laptops sold in the U.S., citing these new tariffs as a key driver. The company is also exploring relocating production lines to America. ASUS has adopted a proactive approach by stockpiling inventory destined for the U.S., while closely monitoring policy changes to maintain competitiveness.

Exemptions and Alternatives

Although semiconductors are exempt from reciprocal tariffs this time around, AI servers are not. Nobunaga Chai, Vice Managing Director at Cloud Express, a media associated with Taiwan’s Legislature, suggested that American high-tech firms could mitigate tariff impacts by establishing regional logistics hubs. Countries such as Singapore or Ireland face relatively lower tariffs, according to Global Trade Alert, which is supported by the University of St. Gallen in Switzerland (see chart below). Canada and Mexico also remain viable options due to exemptions under the USMCA Free Trade Agreement.

The ripple effects of Trump's sweeping tariff policies highlight the interconnected nature of global trade and its vulnerabilities when disrupted by unilateral actions. As companies scramble to adjust their operations and governments prepare diplomatic responses, it remains unclear whether these measures will achieve their intended goals or exacerbate existing economic tensions. The coming months will test whether resilience or retaliation will define international trade relations in this new era of protectionism.