Untangling Trump’s Tariff Web: Taiwan’s Semiconductor Moves Across UMC, Intel, and the Middle East

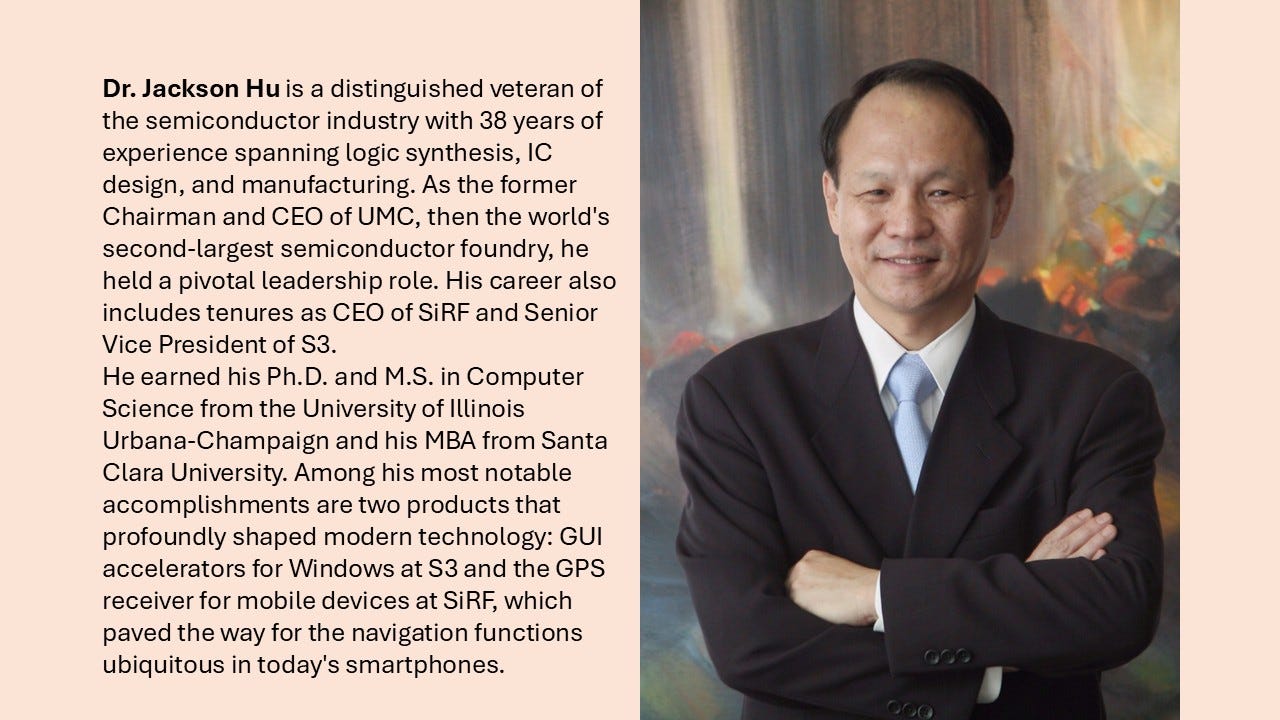

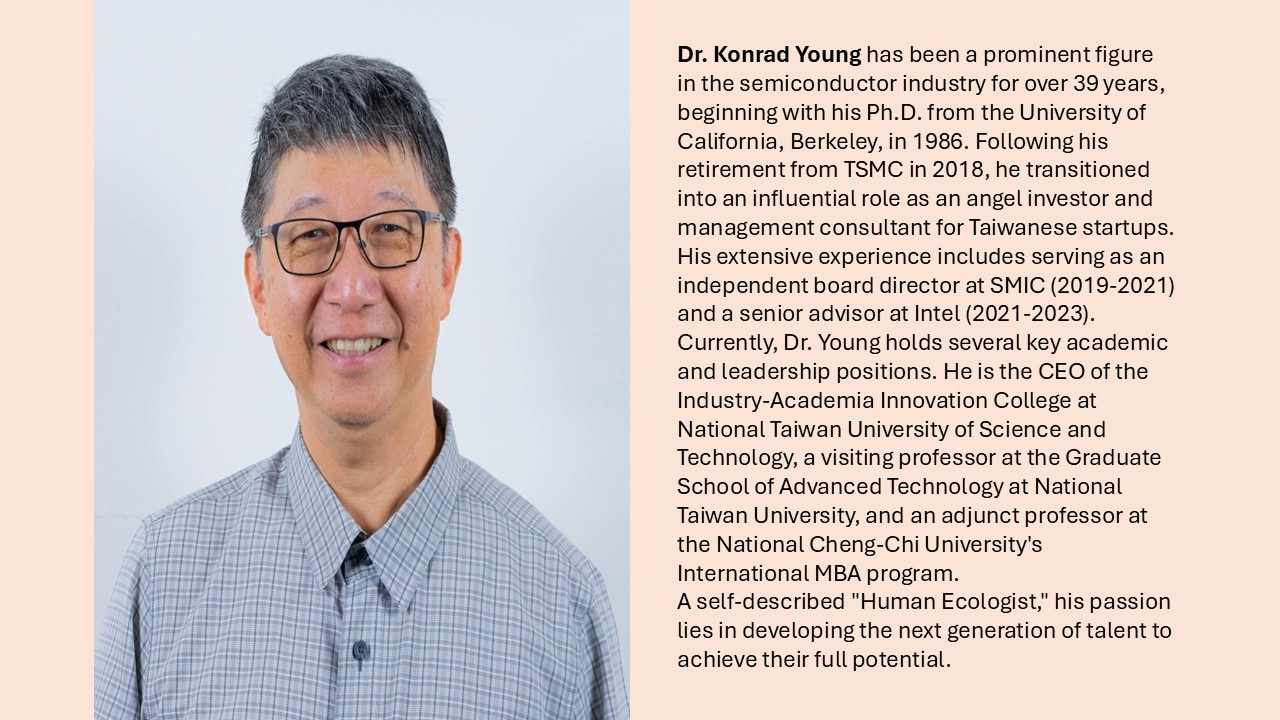

In a recent interview, industry veterans Dr. Jackson Hu and Dr. Konrad Young explore how a potential UMC-Intel alliance could create a "win-win" scenario, and why TSMC's dominance is a liability.

When most people think of the semiconductor industry, one name comes to mind: TSMC, the global giant that controls around 90% of the world’s advanced semiconductor market. Yet, far less attention is paid to Taiwan’s mature-node chip manufacturers—the unsung backbone of everyday technology. These chips power essential products such as refrigerators, toasters, flat-panel TVs, air conditioners, automobiles, and washing machines. Despite their importance, mature-node semiconductors are often overlooked in policy discussions and trade negotiations. Now, with the threat of heavy tariffs looming over these chips, the risk to global supply chains is significant—but few seem to notice.

In a recent interview with TechSoda, Dr. Jackson Hu, former Chairman and CEO of UMC, and Dr. Konrad Young, former R&D Director at TSMC, discussed the severe challenges facing Taiwan's semiconductor industry. They specifically addressed the growing threat of U.S. tariffs, particularly a potential 300% tariff on semiconductors, which imperils Taiwan's mature process manufacturers. In addition, they also talked about why it is important to revive Intel’s foundry capability for America.

They explored how Taiwan can navigate this complex geopolitical landscape by leveraging strategic alliances and exploring new market opportunities in the Middle East.

Below is a summary of the interview, conducted in Mandarin. The full Chinese version is here.

The Shift to a Geopolitically-Driven Market

Dr. Hu began by highlighting a fundamental shift in the global economy. The era of a market-driven, "flat world" is over, replaced by one dominated by geopolitics and national barriers. He cautioned that expecting a return to the old rules of a free-market economy is a mistake, even with a change in U.S. administration, as policies like tariffs are seen as beneficial to American interests. This new reality, he argues, necessitates a cautious and strategic policy from the Taiwanese government. Dr. Young concurred, noting that TSMC's dominance, once a market advantage, has now become a geopolitical liability, raising the risk of U.S. antitrust action.

Challenges for Mature Process Manufacturers

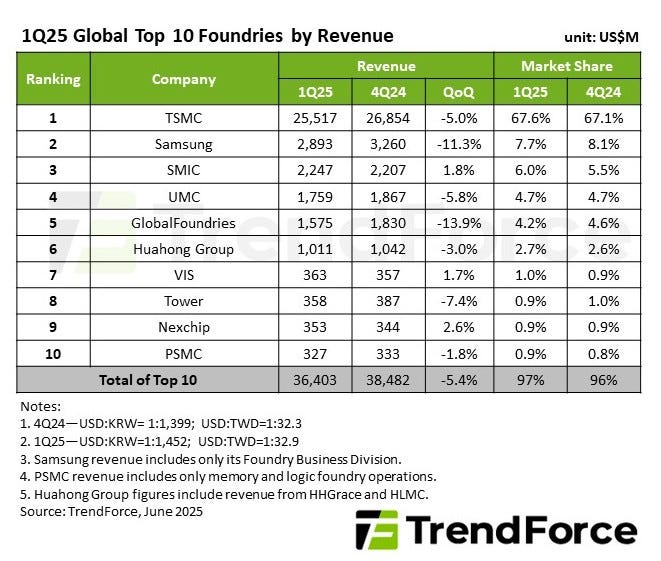

The discussion quickly turned to the direct impact on Taiwan's mature process foundries, such as UMC, Powerchip, Winbond, and Macronix, etc. Unlike TSMC, which has been compelled to expand overseas, these companies have limited feasibility for large-scale expansion in the U.S. Dr. Hu pointed out that UMC, with a significant portion (20%) of its revenue coming from the North American market, is particularly vulnerable to tariffs. By contrast, competitors like GlobalFoundries (GF) are not affected, giving them a distinct advantage. Dr. Hu noted that GF, formed from the merger of AMD's manufacturing arm and Chartered Semiconductor (which he had once sought to acquire), is now a major competitor, with its market value recently surpassing UMC's. Meanwhile, Chinese foundries like SMIC can rely on their vast domestic market to sustain operations, making them less susceptible to export tariffs.

Strategic Solutions for UMC

Both experts agreed that UMC's best path forward is a deeper alliance with, or even an acquisition by, Intel. Dr. Young argued that this would create a "win-win" scenario due to the highly complementary nature of the two companies.

Technological and Manufacturing Complementarity: While Intel excels in R&D for advanced nodes (10nm, 7nm), it has struggled with manufacturing yields. UMC, on the other hand, possesses robust manufacturing capabilities and strong client service, areas where Intel is relatively weak.

Customer Base: UMC's long history in the foundry market provides valuable expertise in client relations, an area where Intel's internal bureaucracy has often hindered partnerships.

Strategic Value: An alliance with Intel would allow UMC to serve as a reliable "second source" for the U.S., potentially securing tariff exemptions and solidifying Taiwan's position as a collaborative partner rather than a competitive threat.

Dr. Hu, while acknowledging the potential benefits, also raised concerns about the synergy, noting that UMC's current 12nm process would require significant technical upgrades to assist Intel's more advanced nodes. He also mentioned that a potential acquisition would be financially beneficial for Intel, especially with the latest announcement of U.S. government investment.

TSMC's Strategic Considerations

For TSMC, Dr. Young believes the most significant long-term risk is an antitrust investigation by the U.S., which could potentially lead to the "Americanization" of its U.S. operations. He firmly believes that helping Intel to revive its foundry and serve as an alternative to TSMC in providing advanced chip manufacturing services is key to preventing TSMC’s dominance from harming itself.

To mitigate geopolitical risks and maintain its competitive edge, Dr. Hu proposed a bold solution: TSMC should consider acquiring UMC. He argued that as TSMC expands globally, its local talent pool is being stretched thin. Integrating UMC's skilled workforce would help TSMC consolidate its domestic talent advantage, a critical factor for maintaining its lead in advanced processes beyond FinFET and GAA.

Emerging Market and "Helper" Opportunities

The conversation also explored new avenues for Taiwan's semiconductor industry. Both experts pointed to the Middle East, specifically the United Arab Emirates, as a promising region. They noted that these nations have a strong desire to build their semiconductor capabilities, possess vast financial resources, and, importantly, have historically enjoyed free trade with the U.S., making them immune to the new tariffs.

Dr. Young suggested that Taiwan could act as a "tech grandparent," helping these nations build their foundational semiconductor industries by licensing older, less advanced intellectual property (IP). This would allow Taiwan to be a partner rather than a competitor, while also creating new revenue streams and opportunities for its companies. Dr. Hu agreed, suggesting that Taiwan could assist these countries in building lower-entry-barrier capabilities like packaging and testing. He noted that Taiwanese companies like ASE are already expanding their operations in the U.S. to support major clients like NVIDIA and AMD.

In summary, Dr. Hu and Dr. Young provided a sobering assessment of the challenges facing Taiwan's semiconductor industry. The interview underscored the necessity for both the government and private sector to recognize the new geopolitical reality and adapt their strategies accordingly. The core solutions lie in strategic partnerships—a deep alliance between UMC and Intel to address U.S. supply chain concerns, and potentially a merger between TSMC and UMC to secure domestic talent. Furthermore, Taiwan should proactively seek out new markets like the Middle East to diversify its portfolio and solidify its role as a key collaborator in the global semiconductor ecosystem.