TSMC will hold its board meeting in the United States for the first time in history on February 11 and 12 to discuss dividends for the previous quarter (24Q4), capital expenditure for the current quarter (25Q1), and its global positioning to navigate geopolitical risks, according to Taiwan’s Economic Daily. What will TSMC deliver in announcements to avoid becoming the key target of the Trump Administration’s 100% tariff?

This unusual arrangement amidst Taiwan’s record high trade surplus in 2024 with cumulative annual exports to the U.S. exceeding US$100 billion for the first time raised a few eyebrows especially when President Donald Trump said he plans to impose 100% tariffs on chips made in Taiwan. Even though TSMC told the press there is nothing unusual because its board meetings are not hosted in fixed places and will be held in Taiwan and other overseas countries where it has offices, that makes people even more curious about what announcement will come out of this meeting.

TSMC’s plans for the second and third fabs in Arizona are on track. CEO C. C. Wei said at the earnings conference that, based on customers' needs, those fabs will utilize even more advanced technologies, such as our N3, N2, and A16.

“We build the capacity overseas due to customers' needs. If my customers have a very high demand, what should I do? I build more fabs, right, with the necessary government support,” Wei addressed analyst questions.

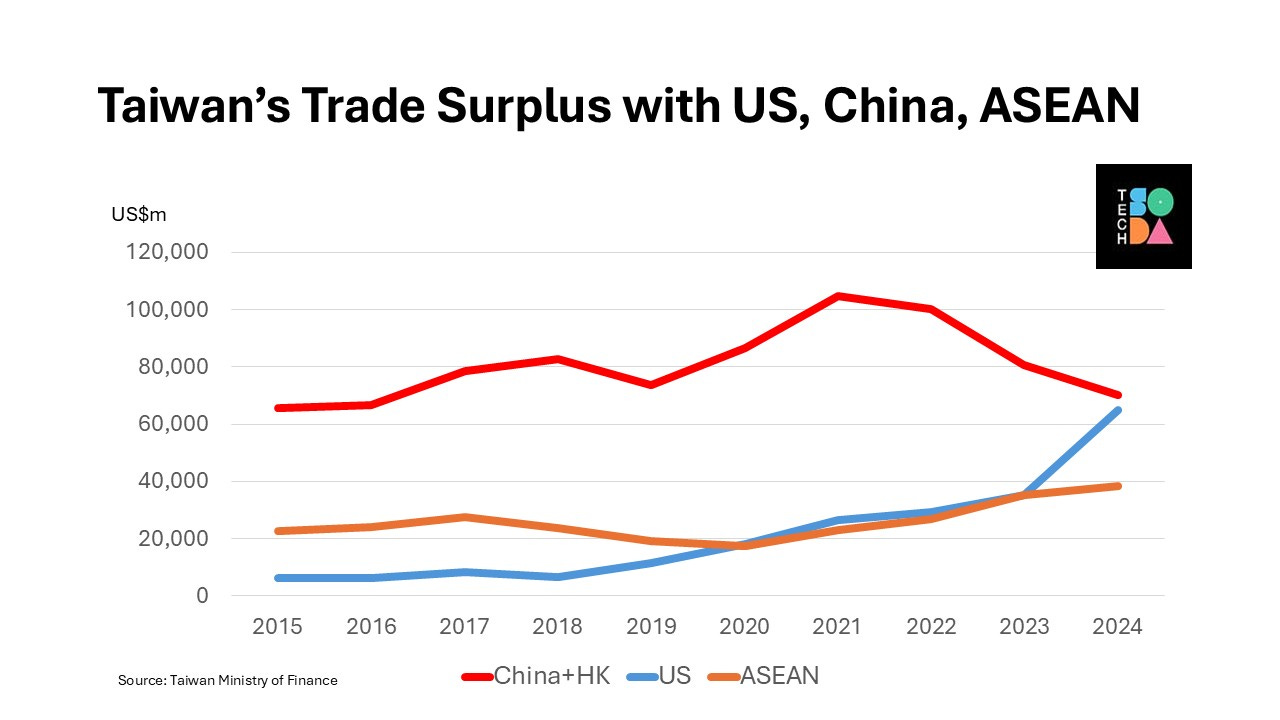

How the US interprets Taiwan’s trade surplus surge is one thing, how it tries to drive more production onshore is another. With global supply chains shifting out of China, as a major producer of intermediary components, Taiwan’s exports to US and ASEAN in 2024 set a new record, accounting for 23.4% and 18.5% of the total exports, the highest in the past 24 years and 7 years; while exports to mainland China and Hong Kong declined by 1.1% and accounted for 31.7% of the total exports, dropping to a 23-year low, according to statistic released by Taiwan’s Ministry of Finance.

Tariff threats are only a tool to get what Trump wants from TSMC, according to some industry veterans in Taiwan.

TSMC has not disclosed the agenda of the board meeting, but it is widely believed the board directors will take a closer look at the operations in its Arizona site and celebrate the success of its mass production at P1 fab there. Since the plot of land at TSMC’s Arizona site is sufficient to accommodate six fabs, there is market speculation saying that the company is likely to increase investments in the US and expand capacities to build more fabs there.

The current board members are: Chairman Dr. C.C. Wei, Dr. F.C. Tseng, Mr. Chin-Ching Liu (Representative of the National Development Fund, Executive Yuan), Sir Peter L. Bonfield (Independent Director), Mr. Michael R. Splinter (Independent Director), Mr. Moshe N. Gavrielov (Independent Director), Dr. L. Rafael Reif (Independent Director), Ms. Ursula M. Burns (Independent Director), Ms. Lynn L Elsenhans (Independent Director), and Dr. Chuan Lin (Independent Director).

Chin-Ching Liu, who is also the Minister of the National Development Council, sees Taiwan’s future growth potential not in manufacturing, nor semiconductor equipment, but in IC design.

“Taiwan already accounts for 67% and 57% of the global foundry and testing market respectively, and the chances of doubling them are zero; equipment and materials account for about 4%, and doubling them is only 8%, which is too small; however, the market share of IC design is 24%, and doubling them is 48%,” Liu said in a CommonWealth Magazine interview last year in May. Giving the United States what it wants (manufacturing) and leveraging its strengths (IC design capabilities and talents) to complement each other has always been welcomed by the Taiwan government for negotiations, but with the premise of fair and mutual benefit.

Previously, some people speculated that the Trump Administration might ask TSMC to acquire Intel, but this was already refuted by Wei by saying that Intel is a customer. Whether there will be requests for TSMC to help out Intel foundry by taking a minor stake and providing technology transfer was also discussed by some gossip. Nevertheless, since TSMC has strictly guarded its trade secrets, this is unlikely.

In the earnings conference, TSMC CFO Wendall Huang forecasts a 2% to 3% margin dilution impact from the ramp-up of overseas fabs. “The impact is less than 100 basis points in the first quarter of 2025, but we expect it to grow more pronounced throughout the year as our fabs in Kumamoto and Arizona ramp up,” said Huang. He said TSMC’s capital budget to be between US$38 billion and US$42 billion in 2025, “as we invest to capture the future growth, about 70% of the capital budget will be allocated for advanced process technologies.”

Ukraine’s disarmament was based on the belief that international agreements would guarantee its security—a belief that proved disastrously wrong when Russia invaded. Similarly, if Taiwan allows TSMC’s technology to be fully transferred to the U.S., it risks losing its strategic leverage, making it more vulnerable in the long term.

To secure its future, Taiwan must carefully balance economic cooperation with national security, ensuring that its technological advantage remains an integral part of its geopolitical strategy.