TSMC Q2 2025 Earnings Conference Takeaways

AI Demands Remain Strong to Sustain Long-Term Growth

TSMC’s Q2 2025 earnings call offered a detailed update on its financial results, technology progress, global expansion, and demand outlook. Despite headwinds from a sharply appreciating local currency and tariff uncertainties, Chairman C.C. Wei expressed confidence that strong AI datacenter demand will sustain growth momentum. He reaffirmed that TSMC’s long-term gross margin target of 53% is well achievable.

After the press conference, CFO Wendell Huang told the local media that TSMC is expected to distribute NT$18 per share for the whole year in 2025, up from NT$14 in 2024. He also said dividends next year are likely to be NT$20, or NT$5 per quarter.

Financial Highlights (Q2 2025):

Revenue: Increased 11.3% sequentially in NTD and 17.8% sequentially to US$30.1 billion in USD, exceeding guidance.

Gross Margin: Decreased 0.2 percentage points sequentially to 58.6%, primarily due to unfavorable foreign exchange rates and margin dilution from overseas fabs, partially offset by higher capacity utilization and cost improvement.

Operating Margin: Increased 1.1 percentage points sequentially to 49.6%.

EPS: NT$15.36, up 60.7% year-over-year.

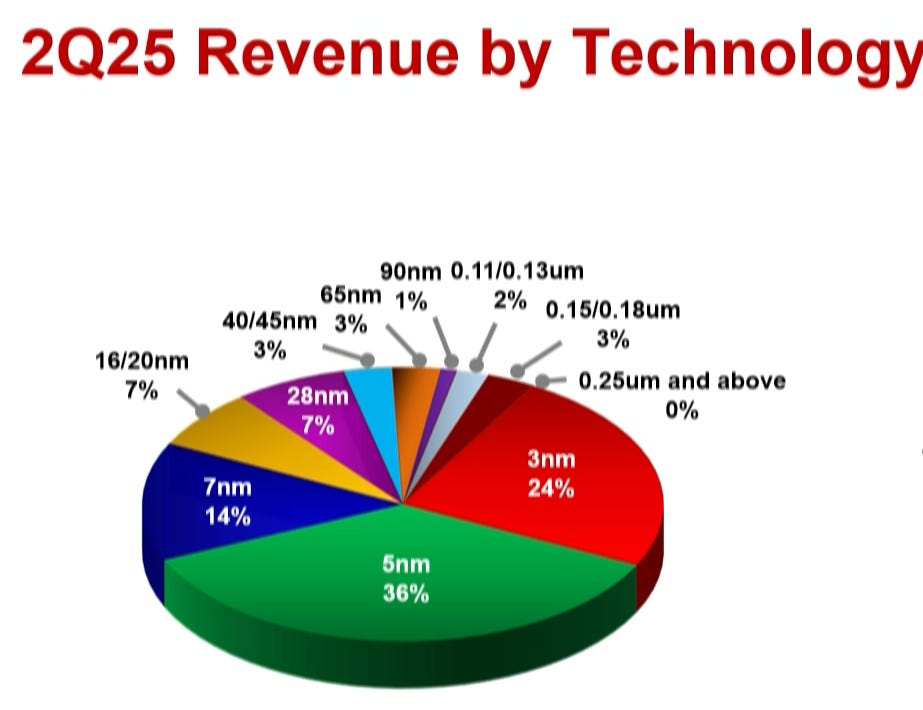

Technology Contribution: 3nm contributed 24% of wafer revenue, 5nm 36%, and 7nm 14%. Advanced Technologies (7nm and below) accounted for 74%.

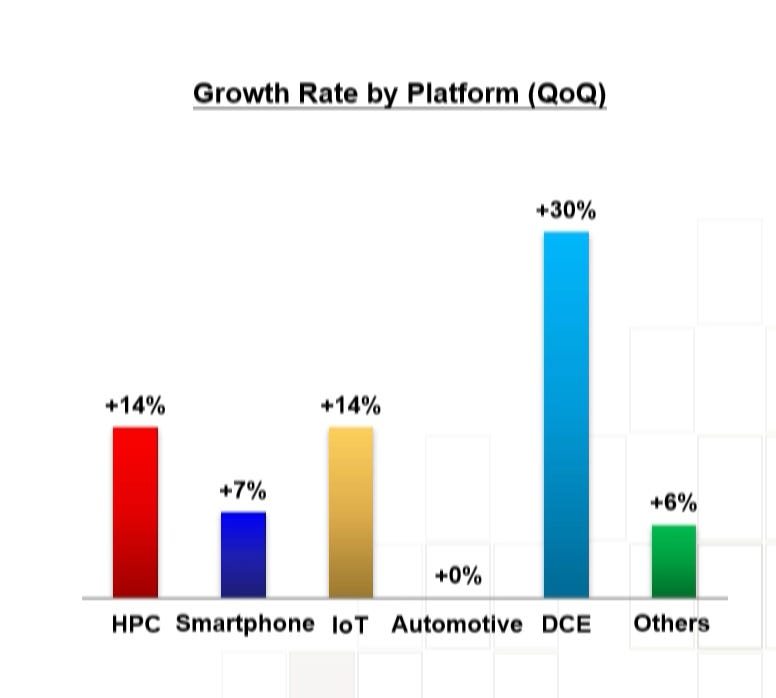

Platform Contribution: HPC increased 14% Q/Q to 60% of revenue, Smartphone increased 7% to 27%, IoT increased 14% to 5%, Automotive stayed flat at 5%, and DCE increased 30% to 1%.

Balance Sheet: Ended with NT$2.6 trillion(US$90 billion) in cash and marketable securities. Accounts receivable turnover days decreased to 23 days, and days of inventory decreased to 76 days.

Cash Flow & CAPEX: Generated NT$497billion in cash from operations, spent NT$297 billion in CAPEX, and distributed NT$117 billion in dividends. Q2 CAPEX totaled US$9.6 billion.

Q3 2025 Guidance:

Revenue: Expected to be between US$31.8billion and US$33 billion, representing an 8% sequential increase (38% Y/Y increase at midpoint).

Gross Margin: Expected to be between 55.5% and 57.5% (midpoint 56.5%), a 210 basis point decrease from Q2, primarily due to continued unfavorable foreign exchange and more pronounced dilution from overseas fabs.

Operating Margin: Expected to be between 45.5% and 47.5%.

2025 Capital Budget: Maintained at US$38-42 billion.

Key Messages & Outlook:

Foreign Exchange Impact: The NTD's appreciation significantly impacts TSMC's financials.

Nearly 100% sensitivity of NTD revenue to USD/NTD exchange rate (1% NTD appreciation reduces NTD revenue by 1%).

About 40 basis points sensitivity of gross margin to 1% NTD appreciation.

Q2 2025: 4.4% NTD appreciation negatively impacted revenue by 4.4% and gross margin by 180 basis points.

Q3 2025 Forecast: 6.6% additional NTD appreciation expected to negatively impact revenue by 6.6% and gross margin by 260 basis points.

TSMC manages this by focusing on other profitability factors (technology, pricing, utilization, cost reduction, technology mix). Long-term gross margin of 53% and higher remains achievable.

Demand Outlook:

Q2 2025 revenue above guidance due to robust AI and HPC-related demand.

Q3 2025 driven by strong demand for leading-edge process technologies.

No change in customer behavior in H2 2025, but uncertainties from potential tariff policies (especially consumer-related).

Mild recovery expected in overall non-AI market segment in 2025.

Full-year 2025 revenue expected to increase by around 30% in US dollar terms, driven by 3nm and 5nm technologies and HPC platform.

AI demand continues to be strong, including rising sovereign AI demand, demonstrating increasing model usage and computation needs for leading-edge silicon.

Global Manufacturing Footprint Expansion:

Decisions are based on customer needs, geographic flexibility, and government support. Investments in the US or advanced processes will not affect the expansion progress in Japan and Germany.

United States (Arizona): Intention to invest US$165 billion for six advanced wafer manufacturing fabs, two advanced packaging fabs, and a major R&D center.

First fab (N4) in high volume production in Q4 2024 with comparable yield to Taiwan.

Second fab (3nm) construction complete, speeding up volume production by several quarters due to strong customer interest.

Third fab (2nm and A16) construction began, speeding up production due to strong AI demand.

Fourth (N2 and A16), fifth, and sixth fabs (more advanced) will be based on customer needs.

Around 30% of 2nm and more advanced capacity will be in Arizona, creating an independent leading-edge cluster.

Japan (Kumamoto): First specialty technology fab started volume production in late 2024. Second specialty fab construction to start later in 2025.

Europe (Dresden, Germany): Progressing smoothly with plans for specialty technology fabs for the automotive industry.

Taiwan: Plans for 11 wafer manufacturing fabs and four advanced packaging facilities, including multiple phases of 2nm fabs in Hsinchu and Kaohsiung Science Park.

Advanced Technology Status (N2, A16, A14):

N2 & A16: Leading the industry for energy-efficient computing. Number of new tape-outs for 2nm expected to be higher than N3 and N5 in the first two years, fueled by smartphone and HPC.

N2: 10-15% speed improvement at same power or 20-30% power improvement at same speed, >15% chip density increase vs. N3E. On track for volume production H2 2025.

N2P (extension of N2): Further performance/power benefits, volume production H2 2026.

A16: Features Super Power Rail (SPR), 8-10% speed improvement at same power or 15-20% power improvement at same speed, 7-10% chip density gain vs. N2P. Best for HPC with complex signal routes. Volume production H2 2026.

A14: Second generation nanosheet transistor structure, 4-node stride from N2. 10-15% speed improvement at the same power or 20-30% power improvement at the same speed, ~20% chip density gain vs. A16. Development on track, volume production scheduled for 2028. Super Power Rail offering planned for 2029.

AI and COWOS Capacity:

AI demand is getting stronger, and COWOS capacity is being ramped up to narrow the gap between demand and supply.

On-device/edge AI momentum is growing, with die size increases (5-10%), but an "explosion" is expected in 6-12 months.

TSMC is building many new backend facilities to increase AI and COWOS capacity.

N3 capacity will be very tight for a couple of years, and N5 also very tight. TSMC is converting capacity between N7, N5, and N3 to meet demand.

Capital Intensity: TSMC does not set capital intensity as a goal; investments are based on future growth opportunities. Expect higher revenue growth than CAPEX growth, leading to lower capital intensity over time.

Humanoid Robots: Too early to determine market size and impact, but seen as a complex, long-term opportunity, especially for medical industry applications, requiring significant sensor technology.

Mature Nodes: TSMC's strategy for mature nodes focuses on specialty technologies (RF, CMOS sensor, high voltage) driven by customer requests, not general overcapacity.

Key Takeaways:

Currency Headwinds are Significant: The appreciation of the NTD is a major challenge, directly reducing reported revenue and substantially impacting gross margins. This is a structural issue TSMC must continuously manage.

AI and HPC are Dominant Drivers: Strong demand for AI and High-Performance Computing (HPC) is the primary engine of TSMC's growth, particularly for its leading-edge 3nm and 5nm technologies, and driving the accelerated ramp of 2nm and A16.

Aggressive Global Expansion: TSMC is undertaking an unprecedented global manufacturing expansion, with massive investments in Arizona, Japan, and Germany, alongside continued growth in Taiwan. This is driven by customer demand, geopolitical considerations, and the need for geographic flexibility.

Leading-Edge Technology Leadership: TSMC continues to push the boundaries of semiconductor technology with a clear roadmap for N2, A16, and A14, emphasizing performance, power efficiency, and density gains to meet the escalating demands of advanced computing.

Capacity Remains Tight: Despite significant CAPEX, capacity, especially for leading-edge nodes (N3, N5, and upcoming N2), remains very tight. TSMC is actively working to "narrow the gap" between supply and demand through conversion and new fab construction.

Operational Excellence to Mitigate External Factors: While foreign exchange is uncontrollable, TSMC relies heavily on its core strengths—technology leadership, manufacturing excellence, and customer trust—to maintain profitability and achieve its long-term gross margin targets.