TSMC Expresses Conservative Optimism for AI Boom in 2026

Capex floor lifted for 2nm Family Ramp-Up and A16 Volume Production Set for 2H26; Management Flags Potential Dilution Factors

Taiwan’s semiconductor foundry giant TSMC voiced optimism on Oct 16 by raising the bottom of its capital expenditure range target for the year (2025) in a bid to meet robust demand for chips needed for artificial intelligence (AI), as it is preparing to ramp up capacities for its N2 family of processes in the second half of 2026.

TSMC chairman C. C. Wei emphasized that while the company’s projected mid-40% CAGR aligns with major customers’ forecasts (excluding infrastructure demand in Europe), the growth in AI “tokens” — a proxy for AI computation and model usage — is exponential, roughly doubling every three months.

This rapid expansion reinforces TSMC’s confidence that demand for leading-edge semiconductors is genuine and sustainable, justifying its continued capacity expansion plans.

“As the structure of AI-related demand continues to be very strong, we continue to invest to support the growth of customers. We are narrowing the range of our 2025 capex to be between US$40-42 billion, as compared to US$38-42 billion,” said CFO Wendell Huang.

Wei admits that the growth in tokens — and the number of tokens being processed — is increasing exponentially, far exceeding TSMC’s projected CAGR. However, he emphasized that as TSMC’s customers move from one process node to the next, they gain the ability to handle significantly more tokens in their fundamental computations. “This reflects our steady progress from node to node, as we work closely with customers to continuously enhance performance.”

Wei expects a faster ramp in 2026, driven by both smartphone and HPC AI applications. “As part of our continuous enhancement strategy, we are introducing N2P, an extension of the N2 family that delivers further performance and power efficiency gains. Volume production is scheduled for the second half of 2026.”

In addition, TSMC is introducing A16, featuring the “best-in-class” Super Power Rail (SPR) technology, according to Wei. A16 is optimized for advanced HPC products requiring complex signal routing and dense power delivery networks. Volume production for A16 is also on track for the second half of 2026.

Wei said he believes N2, N2P, A16, and its derivatives will be another large and long-lasting node for TSMC. He disclosed that TSMC is close to securing a second large piece of land near its Arizona site to support current expansion plans and provide more flexibility in response to the very strong multi-year AI-related demand. “Our plan will enable TSMC to scale up to an independent gigafab cluster in Arizona to support the needs of our leading-edge customers in smartphone AI and HPC applications,” said Wei.

ASML’s strong Q3 2025 financial results resonated with TSMC’s plan to raise its capital expenditure. Of the €7.5 billion in total sales ASML reported in Q3, €3.6 billion came from EUV systems, highlighting the continued robust demand for their cutting-edge extreme ultraviolet lithography technology. ASML’s quarterly net bookings reached €5.4 billion, with the EUV portion being a significant contributor.

Splendid Performance

TSMC delivered a powerful Q3 2025 earnings report with a record net profit jump of 39.1% year-over-year, reaching NT$452.3 billion (about $14.76 billion). With diluted EPS rising to NT$17.44, up from NT$15.36 in Q2.

The revenue for the quarter was NT$989.92 billion ($33.1 billion), representing a 30.3% increase year-over-year and a 10.1% sequential rise.

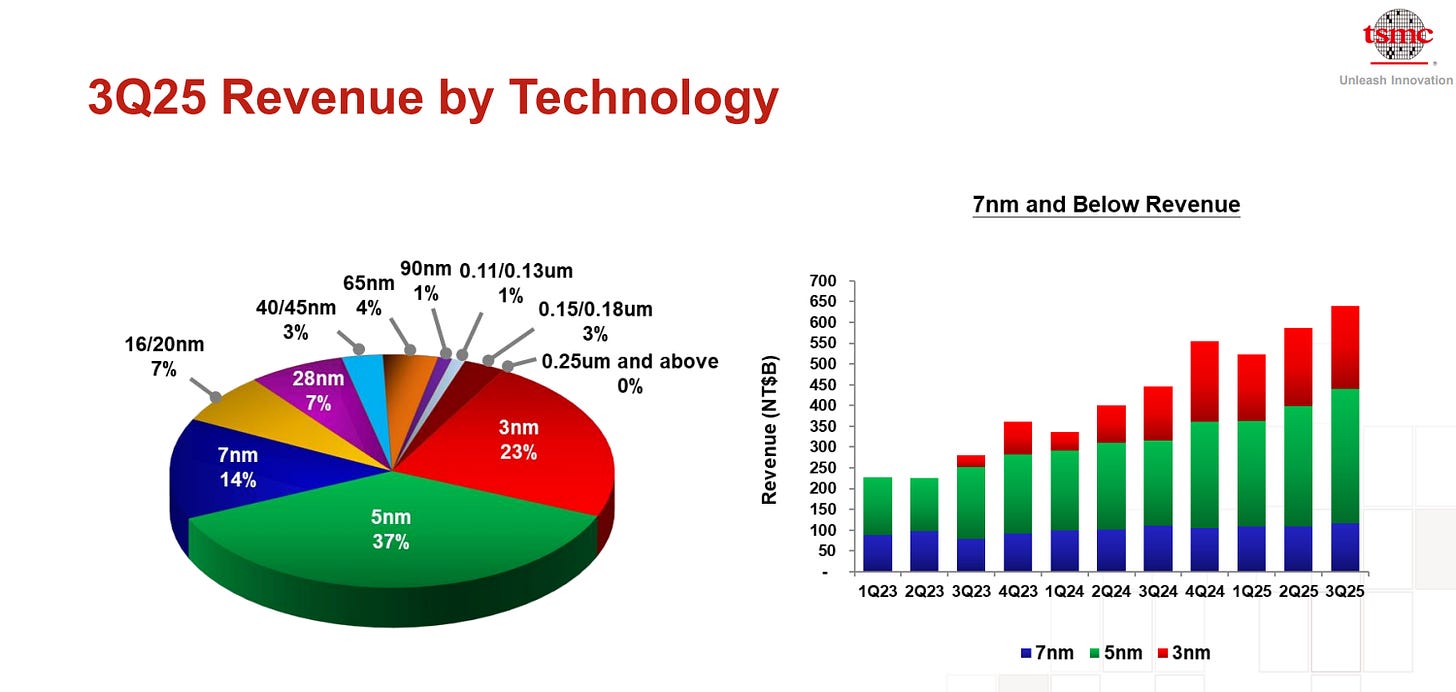

The gross margin improved to 59.5%, driven by robust demand for advanced technologies like 3nm, 5nm, and 7nm processes, which accounted for 74% of wafer revenue.

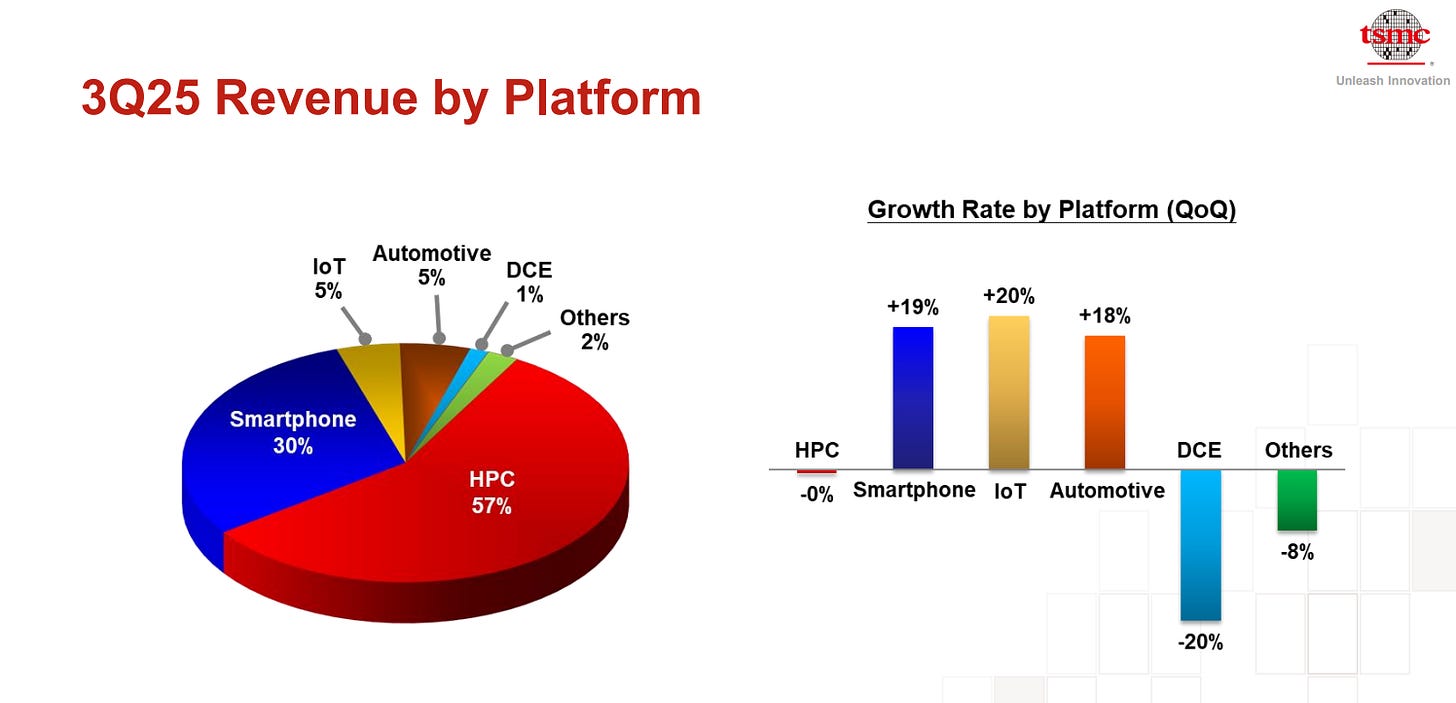

Key growth was driven by strong demand in AI chips, smartphones, and the automotive segment. North America remains TSMC’s largest market, contributing 76% of total net revenue.

Four Things to Watch

1. Zero Growth in HPC Revenues Quarter-over-Quarter

Despite repeated mentions of strong AI chip demand, the flat growth in HPC revenues shown on the bar chart stood out as puzzling. It remains to be seen whether this pause reflects customers waiting for TSMC’s 2nm chips or temporary inventory adjustments in the AI supply chain.

However, Wei also confirmed that for 1GW, cloud customers have to invest US$50 billion, though he did not disclose how much content TSMC has in it, since there are multiple chips in an AI server.

2. Dilution factors

In addition to the gross profit dilution typically seen when introducing new process nodes, CFO Wendell Huang highlighted several other factors. Overseas fab construction will continue to exert pressure, with an estimated 2–3% dilution in the early stages over the next few years. He also pointed to foreign exchange volatility as a challenge, noting that “every one-percent movement of the U.S. dollar against the NT dollar affects our gross margin by roughly 40 basis points.”

For Q4 2025, TSMC expects revenue to decline slightly (about 1%) quarter-over-quarter, but still grow around 22% year-over-year, with revenue projected between US$32.2 billion and US$33.4 billion. The gross margin is expected to remain around 60%.

TSMC reaffirmed its 2025 capital expenditure guidance of US$40–42 billion, with 70% allocated to advanced process technologies. Despite near-term fluctuations, the company remains highly optimistic given the sustained AI-driven demand.

3. Dividends to Continue Growing

TSMC also reassured investors that cash dividends will keep increasing, acknowledging the importance of providing stability amid global market volatility.

Huang stated, “We remain committed to a sustainable and steadily increasing cash dividend per share on both an annual and quarterly basis.”

4. Advanced Packaging Revenue Rising

TSMC’s advanced packaging revenue, now approaching 10% of total revenue, plays a critical role for customers. This importance is a key reason behind its Foundry 2.0 initiative, which aims to deliver enhanced system-level solutions beyond individual chips, said Wei, while commenting that although Intel is a competitor in the Foundry 2.0 space, it is a very good customer and TSMC is working with them on their “most advanced product”.

Looking Ahead to 2026

Analysts maintain a positive outlook for 2026, expecting modest growth supported by the maturing 2nm process and ongoing AI momentum. To offset higher production costs for advanced chips, TSMC plans price increases of 5–10% next year. Over the longer term, the company is expected to deliver continued revenue and stock price growth, underpinned by ongoing investments in new technologies and AI-focused manufacturing.

In Summary

TSMC’s Q3 2025 results exceeded expectations, fueled by strong AI chip demand. While Q4 may see a slight sequential revenue dip, year-over-year growth remains robust, and 2026 is positioned for further expansion driven by next-generation process technologies and strategic pricing. These results reaffirm TSMC’s leadership in advanced semiconductor manufacturing amid the global AI boom.

Incredibly comprehensive breakdown - the flat HPC growth QoQ despite all the AI hype is the most facinating datapoint here and you're right that it's puzzling. Could be inventory digestion or customers waiting for 2nm, but it definitely puts a question mark on the 'AI demand is infinite' narrative we keep hearing. The 2-3% overseas fab dilution persisting for years is also significent - that's a permanent margin headwind from geopolitical insurance that investors need to price in. What really caught my attention is the exponential token growth doubling every 3 months that Wei mentioned, because if that's sustainable it makes the flat HPC revenue even more confusing unless there's major pricing pressure we're not seeing yet. Also the advance packaging approaching 10% of revenue is huge, that's basically a whole new business line emerging. Great analysis pulling all this together.