As TSMC Chairman CC Wei fielded analysts' questions in Taipei, delivering an impressive earnings report—37% revenue growth, a 57% earnings increase, and a 59% gross profit margin—NVIDIA CEO Jensen Huang was making headlines of his own. Huang’s first stop on his Taiwan visit was Taichung, where he attended the opening of Siliconware Precision Industry Limited’s (SPIL) CoWoS advanced packaging facility, a move that underscores the critical role of CoWoS capacity to the success of Nvidia’s business.

Wei, beaming with confidence, told investors, "We now forecast AI accelerator revenue growth to reach a mid-40% CAGR over the next five years, starting from the already high base of 2024. AI accelerators will be the strongest driver of our HPC platform growth."

NVIDIA’s Expanding AI Roadmap

Huang addressed rumors of NVIDIA cutting CoWoS-S orders, clarifying that demand remains robust. Any perceived slowdown, he explained, is merely a shift towards CoWoS-L technology, a more advanced process essential for ramping up Blackwell GPU production.

While recent U.S. export controls continue to tighten, neither NVIDIA nor TSMC appear overly concerned. Instead, their primary focus remains on meeting surging AI demand. A report from Taiwan-based Semi Vision highlights TSMC’s aggressive capacity expansion across Taiwan, estimating that CoWoS capacity will surge at least 1.6x by 2026, from 35,000-40,000 wafers per month to 90,000-110,000 wafers per month.

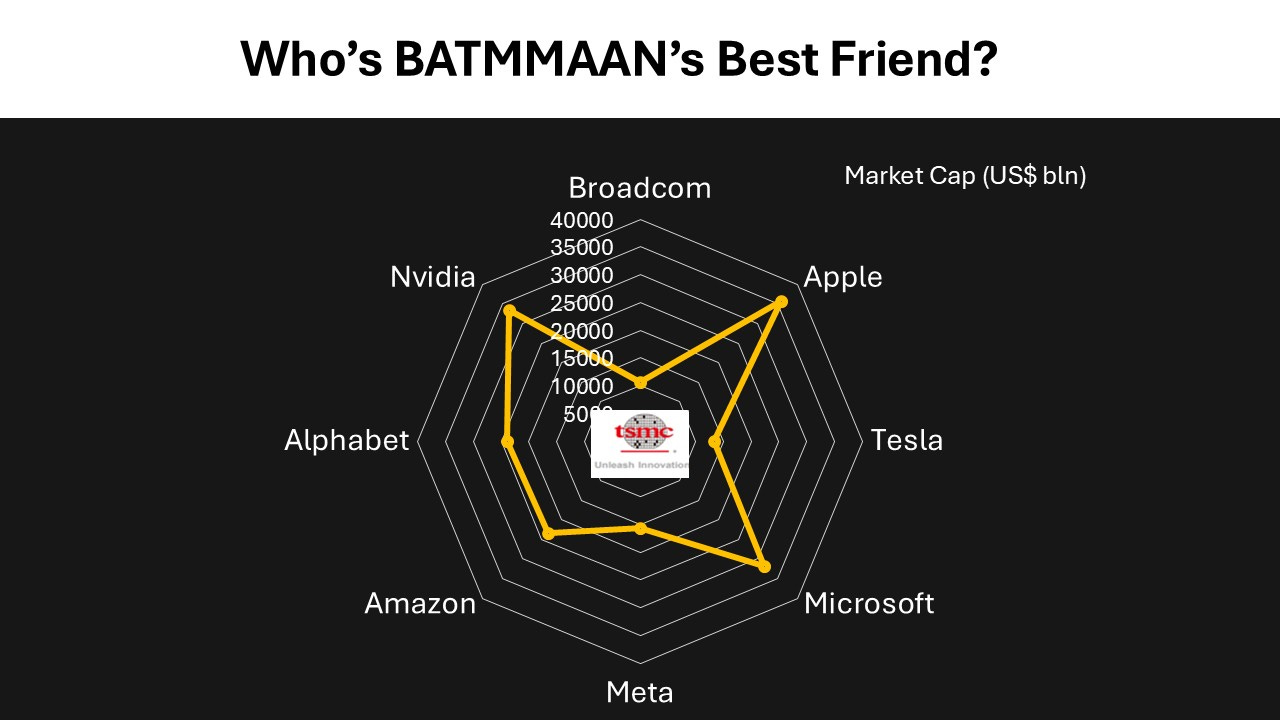

TSMC’s top AI customers include NVIDIA, Broadcom, AMD, Marvell, AWS+AIchip, Intel Habana, and Xilinx. However, the bigger question remains: When will non-AI customers start adopting CoWoS advanced packaging?

“They will, and we know it’s coming,” Wei confidently told analysts. If his prediction holds, TSMC is poised to be BATMMAAN’s most trusted ally—Broadcom, Apple, Tesla, Microsoft, Meta, Amazon, Alphabet (Google), and NVIDIA, a group of eight trillion-dollar tech giants shaping the future of AI.

AI’s Future and Geopolitical Headwinds

Wei asserts that all AI innovators are working with TSMC. Those include companies designing custom ASIC chips like Google, Microsoft, OpenAI, Meta, and even Tesla’s xAI. However, the latest AI diffusion export controls introduced by the Biden administration raise long-term concerns.

Oracle has warned of dire consequences for U.S. innovation, while SEMI and the Semiconductor Industry Association (SIA) have voiced strong opposition. Under the new framework, U.S.-based cloud vendors will face strict AI compute power deployment limits:

50% of AI computing power must remain in the U.S.

No more than 25% can be deployed outside of Tier 1 countries

No more than 7% can be placed in any single non-Tier 1 country

Senior tech analyst Nobunaga Chai told TechSoda that while the new rule may have a limited short-term impact on TSMC, it could slow AI supply chain growth in the long run by restricting access to AI compute power in Tier 2 markets, which include many Middle East countries and Southeast Asian countries, have been investing aggressively in AI development.

According to the Center for Strategic and International Studies (CSIS), the regulations are intended to ensure that the U.S. maintains AI leadership. Gregory Allen, director of the CSIS Wadhwani AI Center, explained, "The goal is not to restrict AI technology diffusion, but to ensure it happens under the right protections."

Will AI Chip Stockpiling Begin?

With the new framework set to take effect in 12 months, uncertainty looms over how the next U.S. administration will handle it. In the meantime, some countries may rush to stockpile AI chips before the restrictions kick in, further reshaping the global AI landscape.

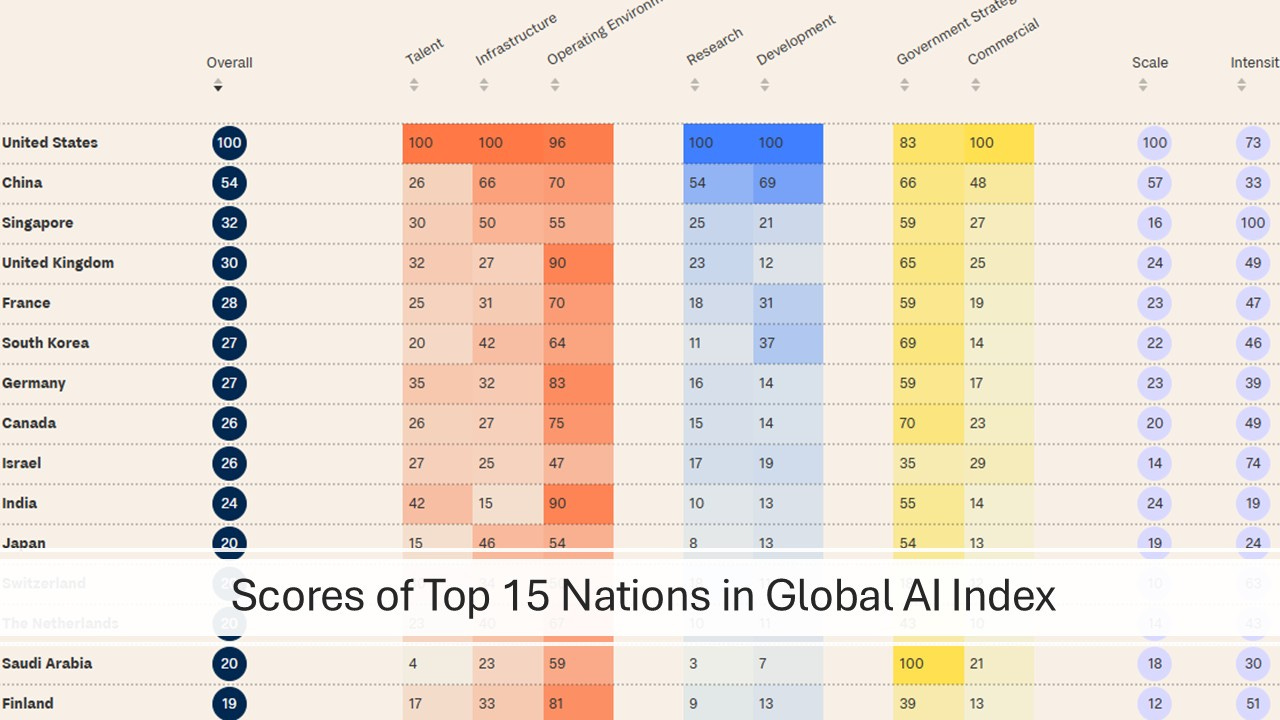

The Global AI Index 2024 compiled by Tortoise Media ranks the United States as the undisputed AI leader, followed by China in second place. However, with stricter AI chip access, new geopolitical shifts may alter the balance, impacting how AI datacenters are built and where the next wave of AI breakthroughs will emerge.

AI's Next Chapter

Despite the geopolitical turbulence, TSMC and NVIDIA remain laser-focused on AI expansion. The real question is not whether AI will continue to grow but how access to cutting-edge AI chips will shape the future of global innovation.