What's Behind Taiwan's 36% Growth in Electronic Exports to US Despite Tariff Threats?

And Japan is Getting Out of Deflation

US President Donald Trump’s tariff threats had an unexpected side effect. Statistics showed that Taiwan’s electronic and information communications exports surged by double digits in the first two months of the year, as customers swarmed to place orders before the tariffs take effect.

The briefing material provided by Taiwan’s Central Bank (CBC) for the quarterly press conference on March 20 showed that exports of electronics and information communications technology (ICT) products surged by 27.7% year-over-year in the first two months of 2025.

“Thanks to robust demand from artificial intelligence (AI) and customers’ request for shipping before the US tariffs take effect, electronics and ICT products enjoyed robust growth in exports in January and February,” according to the Central Bank.

Taiwan manufactures more than 90% of the world’s AI servers and AI chips. Customers including Nvidia, AMD, Microsoft, AWS, and Google depend on it. Although suppliers including Foxconn, Wiwynn, Wistron, Quanta, Inventec, and TSMC invest in building products in America, it takes time to fruition.

Trump threatened to impose a 100% tariff on chips made in Taiwan on the day he returned to the White House, but later announced a 25% tariff on chips made outside the United States. Not surprisingly, Taiwan is included in Trump’s “Dirty 15” list of countries for reciprocal tariffs, effective in April.

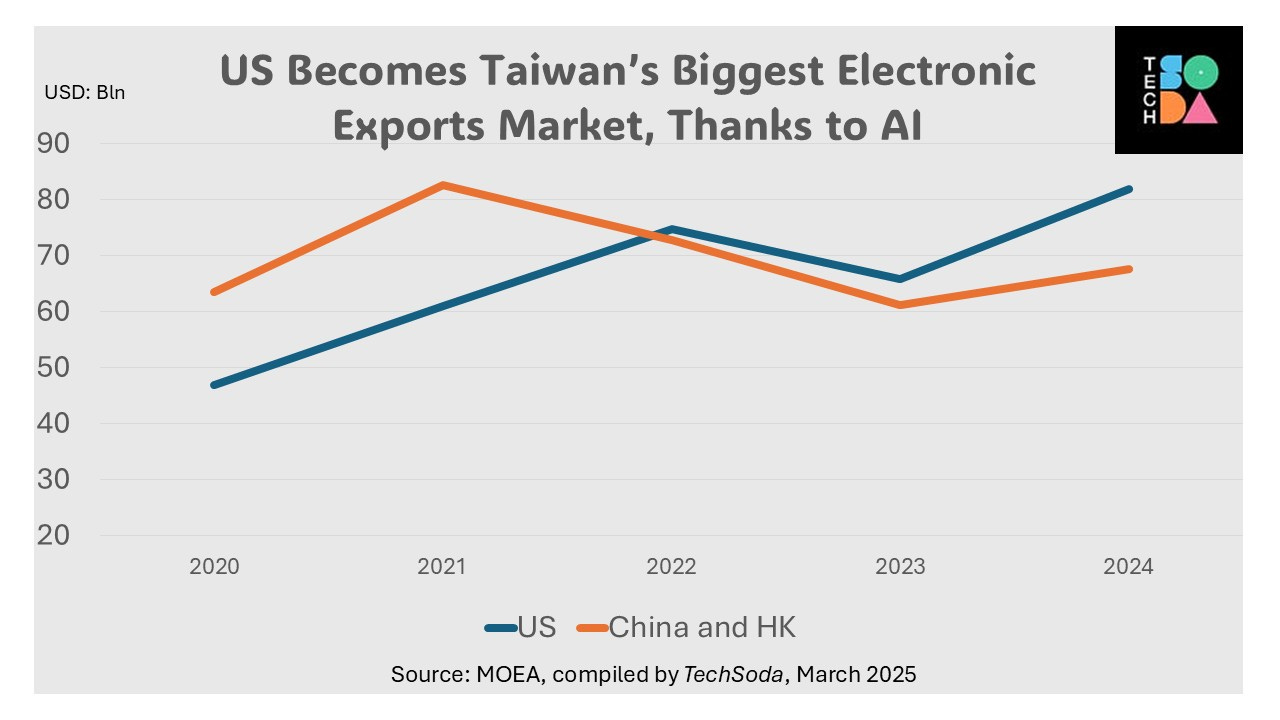

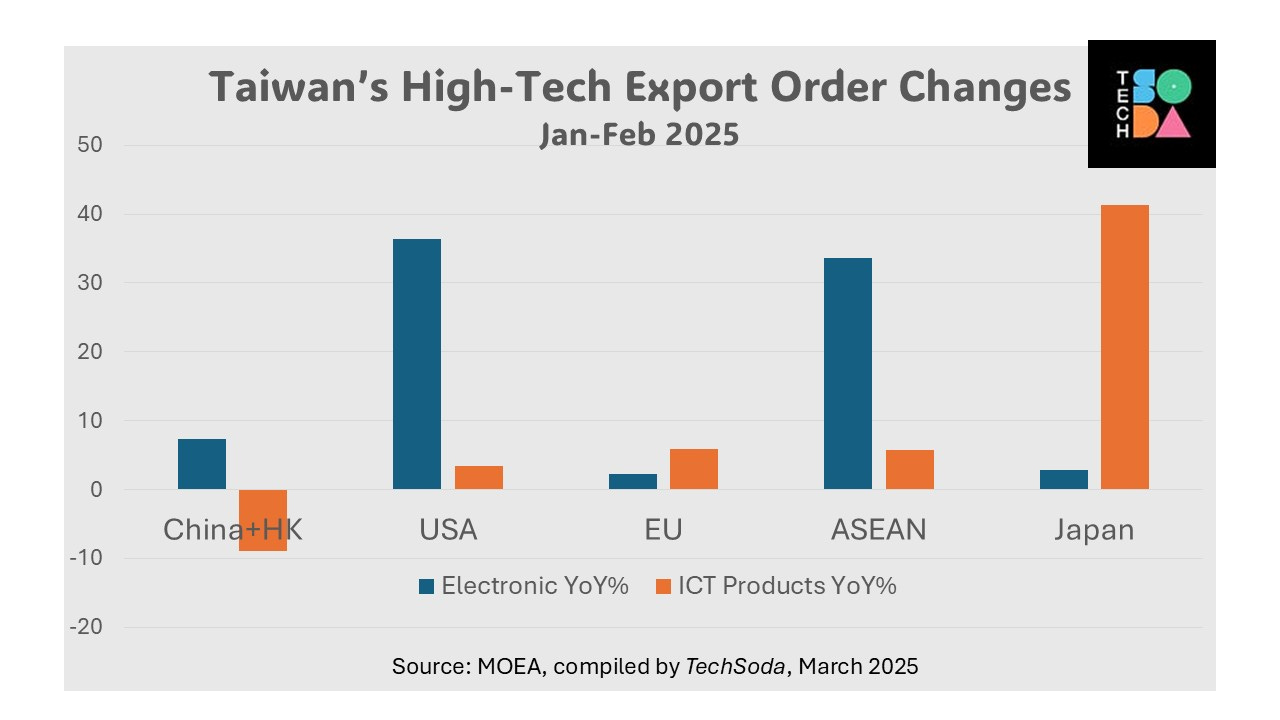

The export order data released by the Ministry of Economic Affairs (MOEA) on the same day provided interesting details of export order distributions. In the first two months of 2025, electronics export orders placed by American customers surged 36.4% to US$15.62 billion, compared to last year. Orders for Southeast Asia during the same period also increased by 33.6%, to US$6.21 billion. Since electronic components including semiconductors are the middleware to be assembled into end products such as computers, smartphones, and home appliances, it is understandable why the export orders for Southeast Asia, an alternative manufacturing hub outside China, are growing at a similar rate to that bound for America.

Since US tariffs are also imposed on exports from other countries that are not abundantly produced in the United States (such as coffee beans or whiskey), a similar phenomenon could occur elsewhere. If exports rise despite increased tariffs, trade deficits may continue widening instead of narrowing.

Interestingly, Taiwan’s export orders of ICT products bound for China have been declining for three years in a row and continued to decline by 9% yearly in January-February.

Although TSMC has pledged to invest an additional US$100 billion in the US, it is not slowing down its investment in domestic capacities in advanced processing nodes and CoWoS advanced packaging. The Central Bank report revealed that imports of semiconductor equipment in the first 2 months increased by 120.9% year-on-year.

Central Bank governor Yang Chin-long warned that the tariff policies of the United States will increase the downside risks of the global economy while pushing up inflation, and said Taiwan’s economic growth may be affected.

China Faces Deflation While Japan Revives

Meanwhile, there is another unexpected side effect of the trend of deglobalization, a result likely contributed by US policy since Trump’s first term.

China’s economy is deeply troubled by weak consumer confidence, high unemployment, and the exodus of foreign investment since the pandemic. The CBC report said China’s economic stimulus on the supply side is only increasing oversupply and does not help to alleviate the risk of a prolonged deflation. Japan, in contrast, is seen stepping out of deflation by boosting employee wages, increasing investments in industries, and reforming its labor markets.

“Japan’s economy has improved significantly in recent years, with its 2-year treasury bill yield turned positive and increased by 90 basis points while the yield of its 10-year bond increased by 144 basis points since December 2021, a sign that Japan is stepping out of the deflation quagmire,” according to the CBC reports.

Japan's core consumer inflation hit 3.2% in January, its fastest pace in 19 months. In February, it slipped to 2.2%. China's core consumer price inflation, excluding food and energy, edged by 0.7% in January but decreased by 0.1% in February year-on-year, marking the first drop since January 2021.

There is a high chance of a reversal of circumstances with Japan moving out of stagflation while China and USA enter stagflation.

Taiwan is uniquely positioned to move towards a “Goldilocks”economy; Steady economic growth, low and stable inflation and low unemployment.