Taiwan’s IC Industry to Grow 22% in 2024, 16% in 2025, according to ITRI IEK

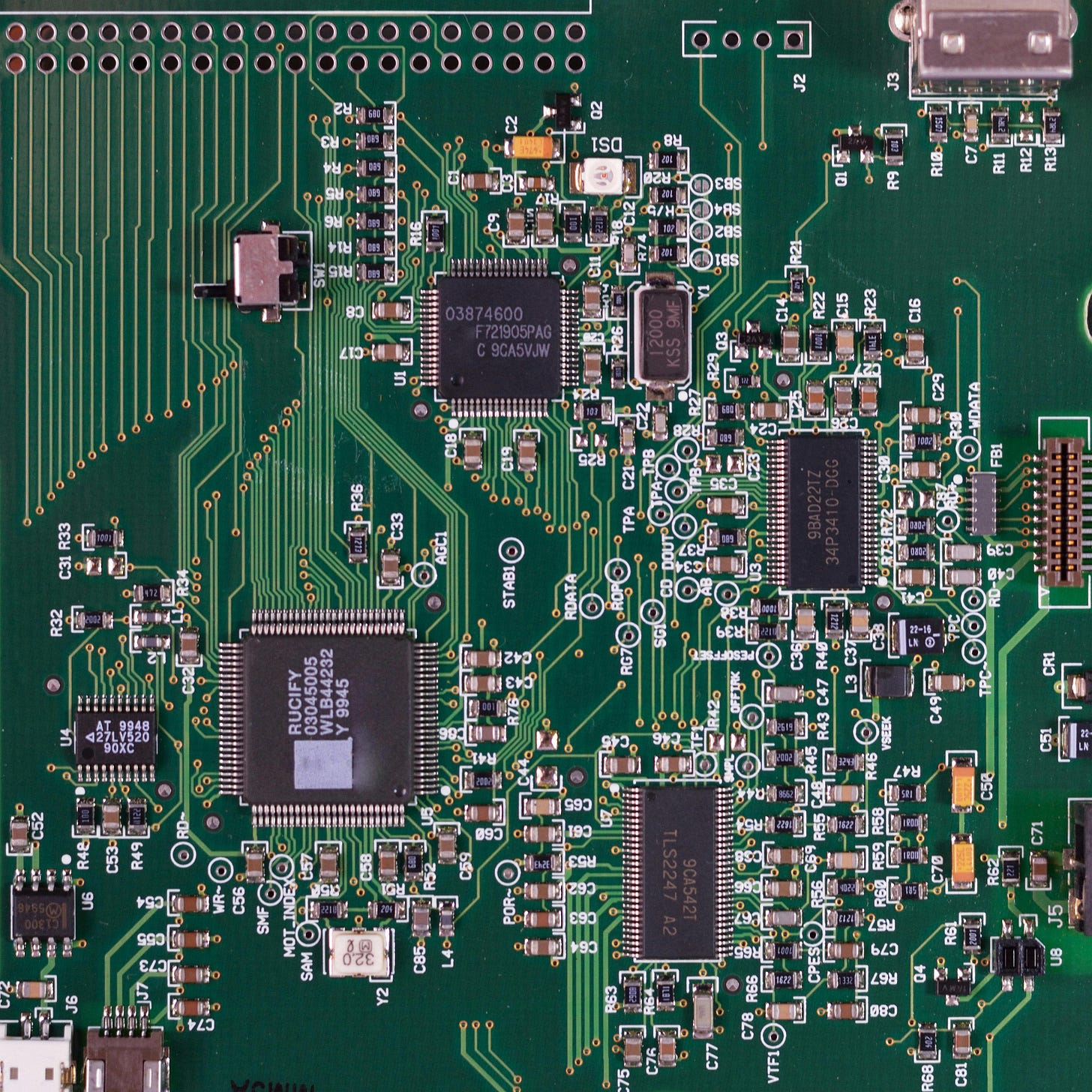

At the "Outlook 2025 Industry Development Trend Seminar" hosted by Taiwan's Industrial Technology Research Institute (ITRI), analysts from the Industrial Economics and Knowledge Center (IEK) projected that Taiwan's integrated circuit (IC) industry will reach a production value of NT$5.3 trillion (US$165.6 billion) in 2024.

This marks a significant year-on-year growth rate of 22%, outperforming the global semiconductor market’s projected 16% growth, according to estimates by the World Semiconductor Trade Statistics (WSTS). This milestone not only cements Taiwan’s leading role in the global semiconductor supply chain but also highlights its critical position in driving innovation for high-tech industries.

The strong growth in Taiwan’s IC industry is largely driven by rising demand for high-performance computing (HPC) chips in key sectors. Global semiconductor output is expected to surpass US$600 billion in 2024, with growth primarily fueled by advancements in smartphones, AI computing, automotive electronics, and data centers. The rapid proliferation of high-end computing applications, such as AI chips and advanced mobile processors, has created unprecedented opportunities for Taiwan’s semiconductor manufacturers, who are well-positioned to supply these cutting-edge technologies.

Looking forward to 2025, driven by the demand for applications such as AI and high-performance computing, the output value of the IC industry in both China and Taiwan is projected to reach NT$6 trillion, with an estimated annual growth rate of 16.5%. This continued expansion reflects the increasing reliance on AI-driven technologies and next-generation computing power, solidifying Taiwan’s role as a critical player in the global semiconductor market.

Communications Industry to See Recovery in 2025

In addition, ITRI IEK expects Taiwan’s communications industry output to grow steadily in 2025, reaching NT$1.3 trillion, a 1.2% increase over 2024. This growth will be driven by the normalization of demand following the completion of inventory adjustments in the global network communications sector. Taiwan's production of communication equipment, such as high-speed fiber optic access devices, Wi-Fi 6/6E wireless systems, and 5G compact base stations, will continue to play a significant role in meeting global market needs.

As cloud computing and communications infrastructure development continue to expand, Taiwan’s manufacturers are set to benefit from rising demand for network equipment across global markets. With the inventory correction in the communications sector expected to conclude by the second half of 2024, demand for communication infrastructure equipment is projected to recover in 2025. This includes increased exports of DOCSIS 3.x cable products, Wi-Fi 6/6E wireless equipment, 5G fixed wireless access (FWA) systems, and other next-generation technologies.

In summary, Taiwan’s semiconductor and communications industries are poised for significant growth in the coming years. The 22% year-on-year growth in 2024’s IC production value reflects Taiwan’s strategic role in supplying the global tech ecosystem with innovative solutions. As demand for advanced computing chips and communication technologies grows, Taiwan’s position as a global leader in semiconductor manufacturing and communication equipment production will only strengthen. The upcoming years present enormous opportunities for Taiwan to expand its technological influence and sustain its competitive edge in the international market.