Possible Impact of US Requiring Measures to Limit Advanced Chip Flow by TSMC to China (Updated)

The US Department of Commerce’s Bureau of Industry and Security (BIS) released two rules on Wednesday: one that updates export controls on advanced computing semiconductors, and another that places additional entities in the People’s Republic of China (PRC) and Singapore on the Entity List. These measures build upon a series of restrictions imposed by the Biden administration in recent years. According to a previous estimate, the restriction on exporting advanced chips to China may have a 5-8% impact on TSMC’s revenues.

The proposed rules are expected to compel manufacturers like TSMC, Samsung Electronics, and Intel Corporation to more rigorously evaluate their customers' ties to blacklisted Chinese organizations, according to the Bloomberg report.

Luke Lin, a senior tech analyst based in Taipei, commented that today’s new rules are responding to the semiconductor industry’s skepticism that countries not on the AI-18 list will seek other sources of arithmetic power, such as AI chips from Chinese companies (like Huawei).

“The announcement today makes it impossible for Chinese companies to produce regulated types of chips through advanced manufacturing processes overseas,” wrote Lin. “This, of course, should be coupled with a strong block on China's ability to increase its local advanced manufacturing capacity and R&D equipment.”

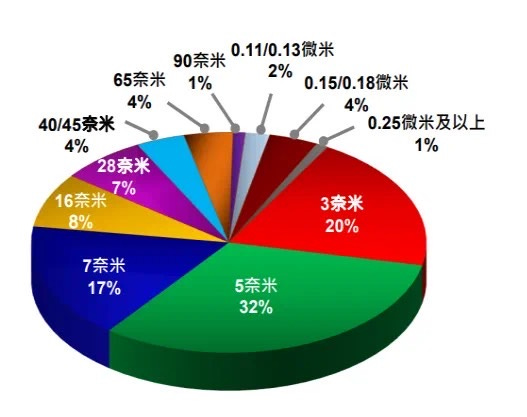

Meanwhile, updates include “16/14 nanometer node,” “Aggregated approximated transistor count,” “Applicable advanced logic integrated circuits,” “Front-end fabricator,” and “Outsourced Semiconductor Assembly and Test (OSAT)” also made to assist the public to easily find the definition for these terms, because they are used in multiple parts of the Export Administration Regulations (EAR).

The definition of advanced chips is upgraded to 16/14 nm, as it is the starting node of FinFET process. In Q3 2024, advanced chips (16nm and below) accounted for 77% of TSMC’s revenue.

TSMC’s due diligence effort

In November 2024, TSMC informed its Chinese clients of a temporary suspension in shipments of advanced AI-related chips manufactured using 7nm or more advanced process nodes. This decision followed revelations from a teardown of Huawei's 910B chip, which showed it utilized TSMC’s 7nm process chips. Additionally, Sophgo, an affiliate of Bitmain and a long-time TSMC customer, was suspected of placing orders for advanced AI products on Huawei’s behalf. TSMC also recently severed ties with PowerAir, a Singapore-based firm believed to be acting as an intermediary for Huawei, potentially violating U.S. export regulations.

TSMC has complied with US regulations and informed its clients in November that all future projects involving advanced processes for Chinese customers will be subjected to stringent reviews to ensure compliance with regulations and prevent chips from being used for AI or other restricted purposes.

A report by TrendForce estimated that the enforcement of these regulations could affect TSMC’s revenue and utilization of its advanced process capacities (7nm and below), while also hindering the development of China’s AI industry.

In 2023 and the first three quarters of 2024, TSMC’s revenue from China remained stable at 11%-13% of total revenue. However, if advanced process reviews expand or additional Chinese customers are added to the Entity List, it could disrupt Chinese AI-related IC design firms, IP companies, third-party design services, and other businesses. Wealth Magazine, a Taiwanese media outlet, projected that this could reduce TSMC’s overall revenue by 5%-8%. The impact of the latest measures is likely to go beyond that.

The U.S. recently introduced AI diffusion export controls to tighten restrictions on global access to advanced AI chips. The measures require data centers in non-U.S. allied countries to obtain licenses for procuring AI chips, while countries deemed hostile will be denied access to these advanced technologies.

TSMC is to host its earnings conference on January 16 afternoon Taipei time, and is expected to have a detailed explanation on the latest US rules.

The company reported a 57.8% year-on-year growth for its December revenues, bringing the whole year's revenue to NT$2,894 billion (US$87.8 billion), up 33% YoY.

Foundries, IC designers and Packaging Firms

According to the BIS press release, the IC designers and packaging companies are also involved in the latest rules requiring more stringent due diligence efforts.

“The Biden-Harris administration is committed to preventing the misuse of advanced U.S. technology and curbing the national security concerns raised by the People’s Republic of China’s military-civil fusion,” said Under Secretary of Commerce for Industry and Security Alan F. Estevez in a press release. “By enhancing due diligence requirements, we are holding foundries accountable for verifying that their chips are not being diverted to restricted entities.”

Among other changes, the rules:

Impose a broader license requirement for foundries and packaging companies seeking to export certain advanced chips, unless one of three conditions is met:

The export is to a trusted “Approved” or “Authorized” integrated circuit (IC) designer, who attests that the chips fall below the relevant performance threshold;

The chip is packaged by a front-end fabricator in a location outside of Macau or a destination in Country Group D:5 and the fabricator verifies the transistor count of the final chip; or

The chip is packaged by an “Approved” outsourced semiconductor assembly and test services (OSAT) company that verifies the transistor count of the final chip.

Create a process for new companies to be added to the list of Approved IC designers and OSATs.

Improve reporting for transactions involving newer customers who may pose a heightened risk of diversion.

Update other parts of the Export Administration Regulations (EAR), including the recent AI Diffusion rule, to ensure that license exceptions are only available for transactions involving approved or authorized IC designers.

Make technical corrections to the December 2 export controls, including to update the definition of “advanced-node integrated circuit” in § 772.1 for Dynamic Random-Access Memory (DRAM) chips.

Add 16 entities to the Entity List, including AI companies like Sophgo Technologies Ltd., that are acting at the behest of Beijing to further the PRC’s goals of indigenous advanced chip production, which poses a risk to U.S. and allied national security.