From 5G to Space: TMYTEK’s MMwave Modules and the Rise of Multi-Orbit Satellite Connectivity

Leveraging "Lego Topology" to implement modular, cost-saving design strategy.

TMYTEK, a Taiwanese startup positioning itself as a “fabless millimeter-wave (mmWave) module design house,” is breaking away from the traditional semiconductor foundry model. Leveraging its core Phased Array Antenna technology, it is becoming a critical driver in the paradigm shift of the global communication market.

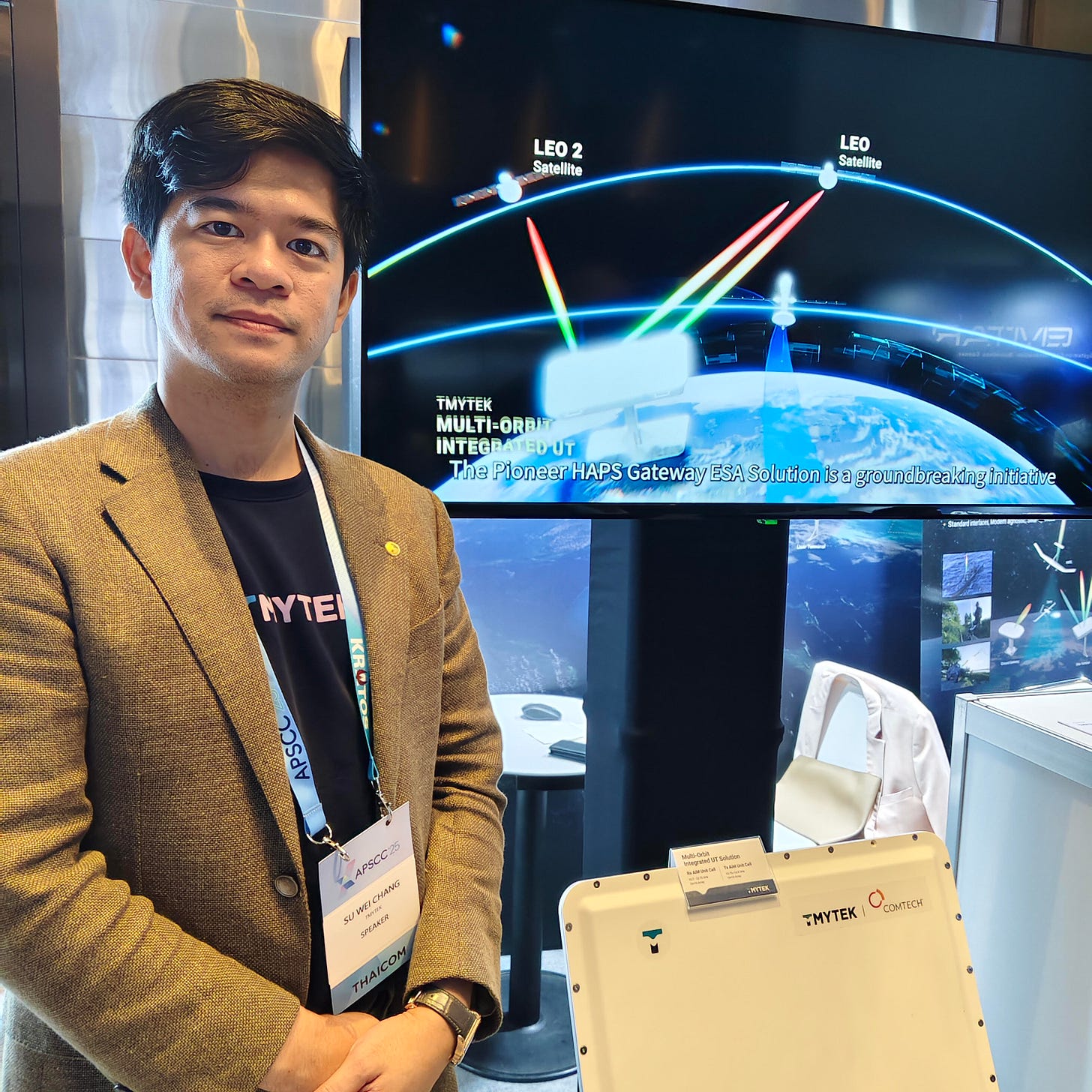

During an exclusive interview with TechSoda on the sidelines of the “APSCC 2025 International Conference” in Taipei, the company’s Co-founder and President, Dr. Su-Wei Chang, expressed optimism that the paradigm shift in the satellite communication industry is bringing many opportunities. Despite fierce competition in the mmWave and phased array antenna fields, TMYTEK has formulated strategies to gain an advantage and maintain high-speed growth.

Strategic Focus: Module and Subsystem (M&S)

Although the founder has an IC design background, TMYTEK chose to avoid the highly competitive and capital-intensive IC design sector. Instead, it focused on the Phased Array Antenna (PAA) Module and Subsystem. Chang believes that the enormous resources and ecosystem required to develop ICs in Taiwan are exceptionally challenging for a startup. Therefore, TMYTEK decided to specialize in antenna modules, using Taiwan’s supply chain advantages in this field to position itself as a “downstream outlet” for IC companies and a deep partner for system integrators.

The “Lego Topology” Concept for Cost-Effectiveness

To effectively address the satellite market’s extreme sensitivity to cost, TMYTEK proposed the “Lego Topology” concept:

Modular Design: Products are highly modular, with core functions designed as standardized “Lego bricks.”

Efficiency and Cost: For each new project, only about 30% of the specifications need to be custom-designed, while up to 70% of the design can reuse standard modules.

Production Volume Accumulation: Since modules can be reused across different projects, TMYTEK’s total production volume accumulates, thereby reducing the average cost per module.

Leveraging its positioning as a fabless design house, TMYTEK targets a gross profit margin for its module products between 30% and 50%, significantly higher than the typical hardware manufacturing industry, ensuring that its technological advantage translates into robust profitability.

Deep Collaboration with Comtech: Building Multi-Orbit Resilient Networks

TMYTEK’s collaboration with the global satellite communications leader, Comtech, is a model of deep linkage between a Taiwanese startup and an international major player. The two companies recently co-announced a “Multi-Orbit Satellite Resilience Network Solution” at the Satellite 2025 exhibition in Washington D.C.

In their system architecture, Comtech provides the Modem, acting as the “brain” responsible for message processing. TMYTEK provides the Phased Array Antenna, which functions as the “front-end system,” equivalent to the communication network’s “eyes, ears, and mouth,” responsible for physical communication.

Previously, Comtech President Dr. Vagan Shakhgildian, in an interview with TechSoda, stated his belief that “the ecosystem is more important than the supply chain,” and cited TMYTEK as a prime example of participating in Taiwan’s R&D Ecosystem. TMYTEK utilizes Taiwan’s robust supply chain, including shareholders such as Inventec and the EMS (Electronic Manufacturing Service) factory under the Kenmec Group, and high-frequency connector supplier EZconn, to quickly complete the entire process from design to assembly, testing, and packaging in Taiwan.

More crucially, TMYTEK can leverage the global manufacturing capabilities of Taiwan’s “Big Five” EMS companies to meet clients’ demands for localized manufacturing and reduced stocking costs. This enables rapid product deployment and supply chain backup, which is vital for customers seeking communication resilience.

Cross-Domain Applications and Future Market Outlook

TMYTEK’s mmWave technology is currently applied across four major business segments: Satellite Communication, 5G/6G Mobile Communication, Automotive, and Defence.

In the automotive sector, the application showcases the immense potential of mmWave technology as a non-contact sensor. For instance, TMYTEK uses mmWave radar to implement Child Presence Detection inside vehicles, a technology that can monitor breathing and heartbeat with an accuracy of up to 90%.

“Compared to cameras and infrared sensors, which are susceptible to light, high temperatures, or privacy concerns, mmWave offers the advantages of privacy protection and greater environmental resistance, especially in high-temperature car environments where heatstroke is a risk for children,” said Chang. “Furthermore, mmWave radar is evolving toward 4D radar (similar to LiDAR), indicating its potential for high-precision sensing despite a higher price point.”

During the forum at the “APSCC 2025 International Conference,” held for the first time in Taipei from November 4th to 6th, Chang, serving as a panellist, also pointed out that High-Altitude Platform Systems (HAPS) are considered a key component of next-generation Non-Terrestrial Networks (NTN). HAPS can form a bridging layer between satellites and terrestrial networks, creating a scalable, low-latency, and rapidly deployable hybrid communication architecture. This provides a resilient regional solution for disaster relief, national defence, and rural coverage. TMYTEK also showcased its latest advancements in HAPS and multi-orbit satellite communication during the exhibition.

Chang has over ten years of expertise in mmWave transmission technology. He noted that the company’s strategic turning point was the decisive shift of its core technology from the high-demand but capital-intensive 5G/6G Mobile Communication sector to the Low-Earth Orbit (LEO) Satellite Communication market, which has an immediate and rigid need for the technology. This decision was based on a deep insight into the development pace of different industries: Mobile communication’s maturity requires massive capital investment and a long time cycle from operators, while the rise of LEO satellites has created an immediate dependency on Phased Array technology.

The Critical Intersection of mmWave and LEO/MEO/GEO: Phased Array Technology

In the past, mmWave technology had limited application in high-frequency signal bands due to inherent drawbacks such as short wavelength, short transmission distance, and difficulty penetrating buildings. However, as data transmission demand continues to soar and bandwidth resources below 6 GHz become constrained, solving high-frequency signal transmission problems has become a fiercely contested field.

Chang emphasized that in the satellite communication sector, particularly in high-frequency bands like V-Band, mmWave is a long-term, intrinsic frequency band. LEO satellites operate at extremely high speeds, requiring ground terminal equipment to possess fast and precise Electronic Beam Steering (EBS) capability. This makes ESA (Electronic Steered Array), which is Phased Array technology, an indispensable key for LEO communication.

TMYTEK formally established its development focus on phased array modules between 2019 and 2020. “Today, satellite operations are trending toward multi-orbit, cross-satellite LEO/MEO/GEO integration,” said Chang. “TMYTEK’s ESA technology fulfils the need for connecting to different satellites, effectively addressing the demand for speed and efficiency in LEO terminal antennas.”

Looking ahead, TMYTEK is actively planning global expansion. In addition to major markets like the United States and Europe, it is particularly extending its reach to Japan, whose market character favors partners establishing local companies or making concrete commitments. While possessing the technical capability for potential markets like home safety care, the company is currently adopting a more cautious strategy, carefully evaluating the required resources and its role in market entry to ensure steady growth and meet the explosive global demand resulting from multi-orbit network integration.

Read the Mandarin version:

The Lego Topology approach is genuinly clever for managing the cost problem in sattelite hardware. Reusing 70% of modules across projects while keeping gross margins above 30% shows real product discipline. I'm curious how the modular design holds up when customers need deeper customization beyond that 30% threshold, or does standardization eventually limit what you can offer?