Deep Dive: Is TSMC's $100b Investment Signalling A US Chip Revival?

What are the implications for TSMC and Intel?

Taiwan Semiconductor Manufacturing Company (TSMC) Chairman C.C. Wei has unveiled a monumental $100 billion investment plan to enhance its supply chain in the United States. This initiative includes the construction of two advanced packaging facilities, one R&D center, and three new fabs, complementing its existing $65 billion commitment in Arizona. Announced alongside President Donald Trump, the plan was celebrated as a transformative step to increase the share of chips manufactured in the U.S. to 40% of global production. However, market reactions were less enthusiastic—TSMC shares fell 4.2% in U.S. trading and another 2% on the Taiwan Stock Exchange following the announcement.

Does this shift benefit Intel? Not quite. Intel's share price also dropped by 4.17% on March 3 during the U.S. trading session, likely due to dashed hopes that TSMC might support Intel’s foundry services. Meanwhile, TSMC’s major customers also saw declines: Nvidia plunged 8.7%, while AMD and Apple fell 1.6% each.

While Trump and Commerce Secretary Howard Lutnick emphasized that avoiding tariffs was a key motivator for such investments, the market appears to be signaling broader concerns. The announcement has also sparked unease in Taiwan, where TSMC is seen as a "Silicon Shield," a critical factor in U.S.-Taiwan relations amidst potential Chinese aggression. Critics worry that as TSMC becomes more globalized, its strategic value to Taiwan may diminish.

Nonetheless, some argue this move is pragmatic for TSMC given Taiwan's energy policy challenges—such as phasing out nuclear power—and talent shortages due to demographic trends. The investment not only aligns with U.S. goals of reducing reliance on Asian supply chains but also strengthens national security while fostering closer U.S.-Taiwan ties.

As TSMC embarks on this ambitious expansion, the semiconductor industry finds itself at a crossroads, shaped by geopolitical tensions and intensifying competition in AI technology. Whether this investment will mitigate risks or introduce new challenges remains to be seen, but it undoubtedly marks a significant chapter in the evolving global chip landscape.

Even though President Donald Trump and Commerce Secretary Howard Lutnick emphasized that avoiding tariffs was a key motivator behind companies announcing large-scale investments in the U.S., the market has responded with skepticism. TSMC's $100 billion announcement, rather than boosting investor confidence, triggered a 4.2% drop in its U.S.-listed shares and an additional 2% decline on the Taiwan Stock Exchange. This reaction highlights lingering concerns about the broader implications of such moves.

The announcement also sent ripples through Taiwan, where TSMC is regarded as the "Silicon Shield"—a critical factor in maintaining U.S. support for Taiwan in the face of potential Chinese aggression. With TSMC increasingly becoming a global entity rather than solely Taiwan’s crown jewel, many Taiwanese are questioning what this shift means for the island's strategic security. The fear is that as TSMC diversifies its operations abroad, its role as a geopolitical safeguard for Taiwan could diminish.

Some argue that TSMC's decision reflects pragmatism in the face of mounting challenges. Among the options reportedly presented by Trump—one of which included a 100% tariff on semiconductor imports—this investment may have been the most viable path forward. Taiwan’s domestic environment also poses hurdles: its energy policy to phase out nuclear power creates uncertainties in electricity supply, while a declining population exacerbates talent shortages critical to sustaining advanced chip manufacturing.

By expanding its footprint in the U.S., TSMC is not only mitigating tariff risks but also aligning with American goals to bolster domestic semiconductor production and reduce reliance on Asia. This move strengthens U.S.-Taiwan ties while addressing operational vulnerabilities at home. However, it also raises fundamental questions about how Taiwan will navigate its future without relying solely on its "Silicon Shield."

TechSoda’s top 5 articles with highest impressions

TSMC Faces Tough Choices Amid Rumors for Intel Collaboration

DeepSeek’s Rise: Why Microsoft and Nvidia Are Backing It Despite National Security Concerns

NVIDIA’s 2025 CES Keynote: Are We Witnessing the Dawn of a New Era?

A Deep Dive in How TSMC Won Its Place in Global Semiconductor Industry

TSMC Adjusts IC Packaging Policy to Navigate US Restrictions and Mitigate Tariff Risks

TSMC’s increased investment in the United States is poised to significantly boost domestic production of advanced semiconductors, reduce reliance on Asian supply chains, and strengthen U.S. national security. The move also fulfills political objectives, providing President Donald Trump with a high-profile deal while fostering closer U.S.-Taiwan ties—an outcome welcomed by the Taiwan government.

“Taiwan’s strategic location is important,” said Cheney Ho, a retired high-tech industry entrepreneur. “The U.S. cannot afford to lose Taiwan to China due to its strategic value.” However, Ho emphasized that Taiwan cannot rely solely on American protection and must prepare to defend itself, regardless of whether the so-called "Silicon Shield" remains intact.

TSMC’s expanded investment is expected to generate immense economic value, particularly in emerging fields like artificial intelligence (AI) and other cutting-edge applications. The company projects that its U.S. operations will support approximately 40,000 construction jobs over the next four years and create tens of thousands of high-paying, high-tech positions in advanced wafer manufacturing and R&D. Additionally, the investment is anticipated to drive more than $200 billion in indirect economic output across Arizona and the broader U.S. economy over the next decade.

Yet, concerns persist among investors about the broader implications for the semiconductor industry. As the "Chip War" between the U.S. and China intensifies and evolves into an "AI War," questions linger about whether TSMC’s ambitious expansion will mitigate geopolitical, tariff, and antitrust risks—or exacerbate them.

Will this unprecedented investment maximize shareholder value while preserving TSMC’s competitive edge? And can it still play a role in stabilizing Intel’s foundry ambitions? These are questions that will shape not only TSMC’s future but also the trajectory of the global semiconductor industry.

Higher Cost for TSMC but Customers Secured

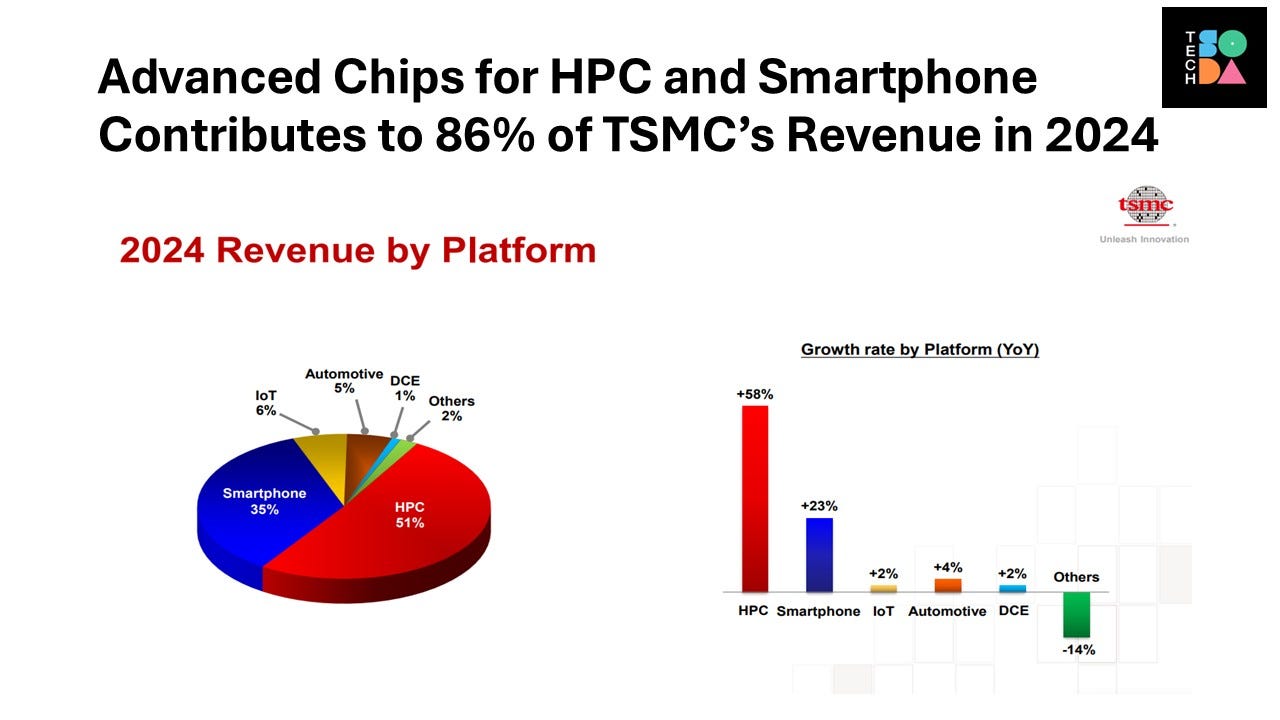

Many industry experts had anticipated an expansion of TSMC’s investment in the United States, but the $100 billion figure still turned heads. While the amount is undeniably massive, securing customer support remains even more critical for TSMC. After all, American companies are the primary consumers of cutting-edge chips, and the race to 2nm technology is already underway, with Intel, Rapidus, and Samsung entering the fray.

TSMC’s first fab in Arizona has already begun producing 4nm chips for major clients like Apple and Nvidia. The second fab is slated to commence mass production by 2028, while construction on a third fab has just begun and will take another two to three years to complete its shell. As Ming-Chi Kuo, a senior technology analyst at TF International, noted, the lack of detailed spending plans in TSMC’s latest announcement provides flexibility to adjust investments based on future market conditions, which could help soften the impact on profitability.

TSMC’s cautious approach is understandable given the uncertainties it faces. Factors such as tariffs on construction materials, inflationary pressures, and restrictive immigration policies that limit the availability of skilled workers could all hinder progress. Even Intel has paused construction on several fabs due to similar challenges.

Despite the headline-grabbing $100 billion commitment, analysts like Kuo and Luke Lin from DIGITIMES emphasized that TSMC’s decision to withhold specifics reflects strategic prudence. This flexibility allows the company to navigate unpredictable variables while maintaining financial stability.

“People often say operating a fab in America is too expensive and that there aren’t enough semiconductor workers to staff production lines,” said Hong-Wen Lin, a veteran semiconductor reporter. “But when Trump pushed for supply chain relocation from China during his first term, OEMs expressed similar concerns. What happened next? With advancements in automation and AI robotics, many tasks now require less manpower. Companies like Foxconn, Wistron, and Quanta are thriving with record-high profits.”

As TSMC embarks on this ambitious expansion, its ability to balance customer demands, operational costs, and geopolitical pressures will determine whether this investment becomes a cornerstone of its global strategy—or a cautionary tale in navigating the complexities of modern semiconductor manufacturing.

R&D Center in Arizona: Pros and Cons?

TSMC’s decision to establish an R&D center in Arizona reflects a broader strategy to tap into U.S. talent, particularly from industry leaders like Intel and IBM. While the move comes with both advantages and challenges, it signals TSMC’s intent to strengthen its foothold in the U.S. semiconductor ecosystem.

Traditionally, TSMC’s R&D centers develop process technologies and conduct pilot runs at a "mother fab." Once yields stabilize, these processes are transferred to other fabs for mass production. By setting up an R&D center in Arizona, TSMC can replicate this model locally for future processes. With American suppliers excelling in materials and equipment—key components of process technology development—Arizona could offer cost efficiencies compared to coordinating between Taiwan and the U.S.

However, the idea of relocating TSMC’s entire R&D team to the U.S. has sparked controversy in Taiwan. When Taiwan was labeled “the most dangerous place on earth,” rumors circulated that the U.S. had drawn up plans to evacuate 200 key TSMC personnel in the event of a Chinese invasion. While Taiwanese officials denied such claims outright, they expressed unease about the implications of moving critical R&D capabilities overseas. “The R&D capability will stay in Taiwan, that is for sure,” one official stated, though without directly addressing the question.

TSMC CEO C.C. Wei has previously emphasized that the company prefers to keep its R&D centers close to manufacturing hubs. So what has changed? Industry experts suggest that there will likely be a division of labor between the Arizona and Hsinchu R&D centers, allowing each to focus on specific aspects of technology development.

Wei has not disclosed details about the size of the Arizona R&D center or how many employees will be recruited locally versus transferred from Taiwan. “If a significant number of staff are relocated from Taiwan, it would hollow out Taiwan’s R&D capacity,” warned Rocky Uriankhai, a geopolitical consultant.

Despite these concerns, establishing an R&D center in Arizona makes strategic sense. It could facilitate closer collaboration with customers as application-specific integrated circuits (ASICs) gain popularity. Innovations in materials and equipment will also benefit from proximity to American suppliers and partners like Google, AWS, and even IP companies like Arm, which increasingly require foundries for chip co-development.

Another potential advantage is a cultural shift in R&D operations. Konrad Young, a retired TSMC R&D director, once remarked that TSMC’s Taiwanese staff often adhere to a “hard work makes perfect” philosophy, prioritizing effort over efficiency. This approach can dilute creativity and innovation by relying too heavily on manpower. An Arizona-based R&D team may introduce fresh perspectives on working smarter rather than harder, fostering innovation critical for breakthroughs in quantum computing and AI.

While there will be a division of labor between the two centers, competition for results is inevitable—just as it is among TSMC’s fabs in Taiwan. Although hiring costs are higher in the U.S., if American talent delivers cutting-edge innovations that drive the semiconductor industry forward into the quantum and AI era, critics who argue that Taiwan is better suited for semiconductor R&D may find their claims losing ground.

Turning Geopolitical Pressure into Growth Opportunities

TSMC’s $100 billion investment in the U.S. represents a strategic win-win for TSMC, Taiwan, and the United States, according to Joyce Yen, a prominent writer in Taiwan. She noted that while Taiwan struggles with limited access to cheap land and electricity, the U.S. offers an attractive alternative for large-scale semiconductor manufacturing.

Hongwen Lin, a senior semiconductor reporter in Taiwan, highlighted the broader implications of this move, particularly in the context of President Donald Trump’s aggressive policies to drive manufacturing back to America. “Companies will no longer base decisions solely on cost or efficiency,” Lin observed. “When politics intervene, the way value is calculated changes.” This shift is evident as the U.S. and China continue to decouple their technology ecosystems, creating a new geopolitical landscape for the semiconductor industry. However, Trump’s tariffs on allies like Mexico, Canada, and the EU have complicated global trade rules, leaving companies uncertain about how to navigate these shifting dynamics.

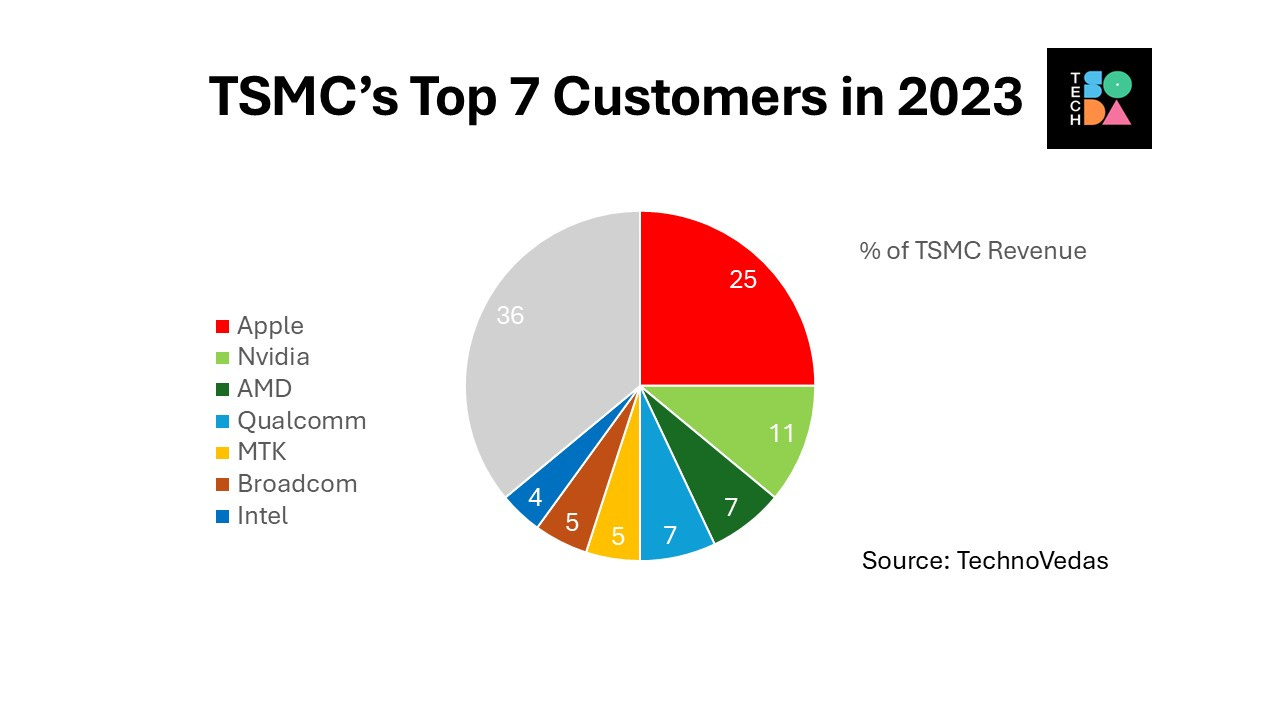

TSMC appears to be treading carefully to align with U.S. political priorities while maintaining its global leadership position. CEO C.C. Wei expressed gratitude to Trump for inviting TSMC to invest in America back in 2020 and credited key U.S. customers—such as Apple, Qualcomm, AMD, and Nvidia—for supporting the initiative. Trump himself underscored TSMC’s dominance in advanced semiconductors, noting its 90% market share in this critical sector. “It better keep its head low and meet customer demands to have their chips made in America,” Trump remarked.

By balancing political expectations with business realities, TSMC is navigating a complex environment where economic security and geopolitical strategy intersect. Whether this approach will sustain its dominance while satisfying all stakeholders remains an open question.

TF-International analyst Ming-Chi Kuo estimated that higher manufacturing costs in Arizona could reduce TSMC’s overall gross margin by 1.5 to 2 percentage points. To offset this and maintain its promised gross margin above 53%, TSMC may need to pressure its suppliers or onboard new ones capable of providing high-quality equipment and materials at lower costs.

TSMC’s decision to align with the U.S. is pragmatic, said C.Y. Huang, a senior investment banker. Over 60% of TSMC’s business comes from American customers, while American institutional investors hold more than 70% of its shares and occupy half of its board seats. “TSMC is more American than Taiwanese in ways most people don’t realize,” Huang noted, pointing out that the company’s founder Morris Chang and its early CEOs were either American or German. Furthermore, all electronic design automation (EDA) tools, critical to semiconductor manufacturing, originate from the U.S., leaving TSMC with little choice but to side with America over China. Chang himself revealed in his memoirs that TSMC’s rigorous manufacturing practices—such as replicating processes from "mother fabs" and fostering internal competition among fabs—were inspired by his tenure at Texas Instruments (TI) and Intel.

Intel at an Impasse

With TSMC now committing $100 billion to U.S. expansion, is America satisfied? “No,” said Rocky Uriankhai, CEO of SciTech Power Research, a geopolitical consultancy firm. He recalled that in January 2023, TSMC announced plans to move 20% of its advanced manufacturing capacity overseas within five years—primarily to the U.S., as no advanced fabs were planned for Germany or Japan. However, during a March 3 press conference, President Donald Trump stated his expectation that the $100 billion investment would result in 40% of advanced chips being produced in America. Whether this ambitious target can be achieved remains unclear, even if all six planned fabs in Arizona are fully operational.

Currently, TSMC’s Arizona site can accommodate six fabs. With three already operational or under construction, only three additional fabs can be built without acquiring new land for the two advanced packaging facilities and the R&D center. Filling these production lines will require significant orders from American customers—including potential collaborations with Intel’s foundry clients.

Meanwhile, Intel claims that its 18A process is a year ahead of TSMC’s equivalent technology. However, without stable yields for commercialization, Intel's foundry business may struggle to secure orders, leaving it at a disadvantage despite its technological ambitions.

Intel has delayed the mass production timeline for its Panther Lake (PTL) processors from early September 2025 to mid-Q4 2025, according to a report by Ming-Chi Kuo. “Until Intel successfully ships chips manufactured on the 18A process, it will struggle to gain the trust of external IC design customers and secure their substantial resource investments for 18A chip development collaboration,” Kuo stated. This delay could also push the availability of PTL-based notebooks into 2026, potentially causing Intel to miss the crucial 2025 holiday sales season and impacting its revenue and profitability.

To meet market demands on time, Intel may need to continue outsourcing chip production to TSMC. However, this reliance could create political friction. “If TSMC Arizona’s six fabs outperform Intel’s own facilities, Trump would not be happy, and antitrust issues could arise,” said Rocky Uriankhai, CEO of SciTech Power Research.

While speculation has surfaced about TSMC investing in Intel Foundry Services (IFS), sources indicate that TSMC declined such proposals. The company has reportedly maintained that it will only operate fabs designed by itself. Nonetheless, Intel remains too strategically important for the U.S., especially as a key supplier of military-grade chips. “Some discussions have even included TSMC’s involvement in Intel’s advanced fab in Ireland alongside its U.S. operations,” an industry expert revealed.

C.Y. Huang, a senior investment banker, believes that the U.S. will do whatever it takes to save Intel’s foundry business. “If advanced semiconductor manufacturing is being brought onshore, America will undoubtedly pull all strings to support Intel,” Huang said. He suggested that restructuring IFS might involve spinning it off into a consortium or holding company and partnering with a capable foundry operator. “Who could that be? Only two names come to mind—TSMC or GlobalFoundries.”

As geopolitical tensions rise and semiconductors become even more entangled with national security interests, TSMC’s $100 billion U.S. expansion reflects both opportunity and risk. While the investment promises tens of thousands of high-paying jobs and significant economic growth, it also underscores the challenge of balancing business priorities with political realities.

For TSMC, this move is not just about navigating tariffs or expanding market share—it is about securing its future in an era of intensifying competition and geopolitical uncertainty. As the "Chip War" transitions into an "AI War," TSMC’s bold bet on America may define its role as a global leader in advanced semiconductor manufacturing. Whether this decision maximizes shareholder value or introduces new challenges remains to be seen, but one thing is certain: the stakes have never been higher for TSMC, Intel, and the semiconductor industry at large.

Support TechSoda to produce valuable content!

A related report from SemiVision: