MediaTek and Qualcomm, titans of the smartphone chip world, are no longer content staying in their mobile strongholds. At Computex 2025, both companies laid out ambitious plans to extend their reach into personal computing, automotive, and data center markets, anchored by AI innovation and powerful industry alliances.

From Mobile Roots to Multi-Sector Titans

For years, MediaTek and Qualcomm dominated mobile System-on-Chip (SoC) design, powering billions of smartphones with increasingly powerful, efficient, and connected chipsets. Now, they're leveraging that legacy as a springboard into adjacent industries.

At MediaTek’s keynote, CEO Rick Tsai emphasized the company’s deep roots, noting its evolution from optical drives in 1997 to smart TVs and Chromebooks, and now, AI-enhanced solutions for PCs, IoT, cars, and servers. “It’s not a sudden jump,” Tsai said, citing over 20 billion chips shipped as a foundation for scale and momentum.

Qualcomm’s CEO Cristiano Amon struck a similar tone. Declaring the company's long-term commitment to PCs, a new market that Qualcomm just entered in a couple of years ago, Amon spotlighted Snapdragon’s evolution from mobile to full-featured computing, with partnerships—especially with Microsoft—serving as a catalyst for this transformation.

AI: The Great Enabler

AI has emerged as the core driver behind both companies’ strategic shifts. MediaTek’s strategy centers on four pillars: powerful compute, AI acceleration, connectivity, and key partnerships. Their Dimensity chips now support over 540 edge AI platforms, including large language models (LLM) like Gemini and LLaMA. Future ambitions include integrating AI assistants into 6G networks and deploying generative AI for advanced applications like computational photography and deep reasoning.

Qualcomm, meanwhile, is pushing AI as the new user interface. With Microsoft’s new Phi models running natively on Snapdragon NPUs, Qualcomm’s chips are now behind over 750 native PC apps and more than 1,400 optimized games. The company also showcased how on-device AI can handle private data securely and efficiently, citing use cases in enterprise productivity, media editing, and smart assistants.

Partnerships as Force Multipliers

Both chipmakers are tapping into an extensive network of partnerships to accelerate growth. MediaTek has aligned closely with NVIDIA, ARM, and TSMC—developing two-nanometer chips and AI-specific silicon for the data center, including the DGX Spark Superchip. Their collaborations extend to generative AI development and advanced packaging techniques like 2.5D and 3D stacking.

Qualcomm, on the other hand, is focusing on building a cohesive ecosystem with partners like Lenovo, HP, Asus, and Microsoft. Their AI Hub platform and integration with Docker aim to democratize AI development, allowing developers to create multi-modal, low-latency AI experiences across devices.

Target Markets: PCs, Cars, and the Cloud

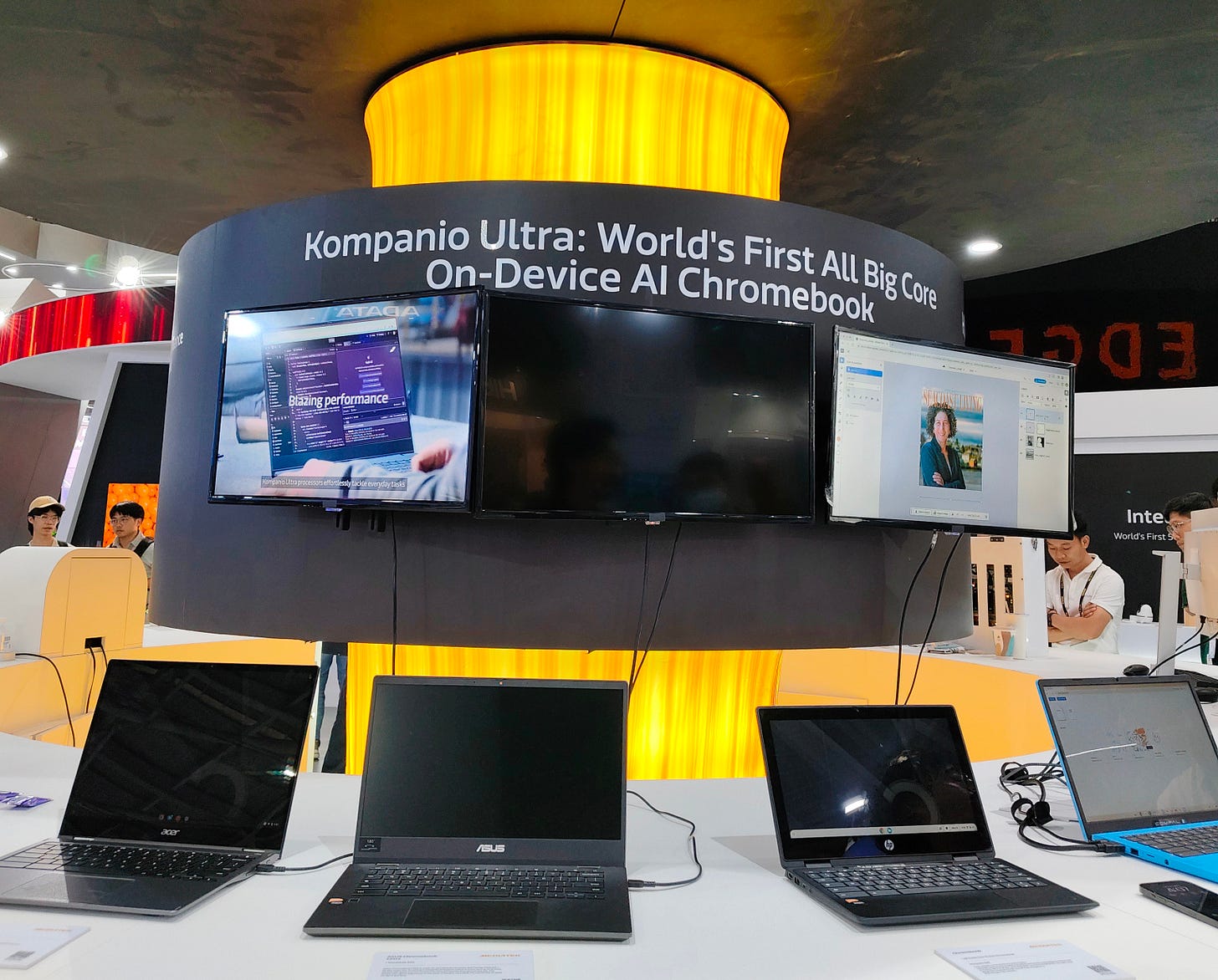

In PCs, MediaTek’s Kompanio Ultra chip promises AI power (50 TOPS), long battery life, and 3nm efficiency—aimed at premium Chromebooks. Qualcomm is betting big on its Snapdragon X Series, now used in over 85 device designs, touting unmatched performance and battery life alongside immersive AI-driven features.

In automotive, MediaTek's Dimensity Auto platform—featuring NVIDIA RTX graphics and dual AI engines—aims to enhance driver safety and in-car experiences. Qualcomm, too, is positioning its chips as the brains behind connected vehicles, with an emphasis on on-device AI and seamless cross-device integration.

In the data center, both companies are taking a two-pronged approach. MediaTek is investing in AI ASICs and high-bandwidth networking chips, while Qualcomm is developing AI-centric CPUs and low-power inference clusters, promising a “disruptive” entry into enterprise AI infrastructure.

The Bigger Picture

What began as a bid to diversify away from smartphones is rapidly becoming a full-scale transformation. MediaTek and Qualcomm are not merely entering new sectors—they’re aiming to redefine them with mobile-style efficiency, integrated AI, and global developer ecosystems.

But competition is fierce. Incumbents like Intel and AMD dominate these domains, and new entrants face steep barriers. Still, both MediaTek and Qualcomm believe their experience with power-efficient, AI-optimized mobile chips gives them an edge.

If their Computex 2025 presentations are any indication, the next decade in computing—from the edge to the cloud—may be shaped as much by mobile DNA as by traditional silicon incumbents.

Share this post