Chip War Intensifies: Countries and Semiconductor Companies Fight for Talent

A Collab Project by TechSoda and SemiVision

Recent raids by Taiwan’s prosecutors on 11 mainland Chinese companies, including Semiconductor Manufacturing International Corporation (SMIC), Torey, and Cloudnix, have exposed a critical front in the global "Chip War"—the fight for semiconductor talent.

These companies allegedly disguised themselves as international firms to establish subsidiaries in Taiwan, poaching local engineers in an effort to gain a competitive edge. As Taiwan tightens its grip on its prized semiconductor workforce, countries like Malaysia are launching bold initiatives to lure talent back home, underscoring the intensifying global competition for skilled professionals in this high-stakes industry.

Burn-Jeng Lin, a retired TSMC veteran and current dean of the College of Semiconductor Research at National Tsing-Hua University in Hsinchu, has criticized the geopolitical tensions surrounding semiconductors. He argues that resolving talent shortages requires reducing political interference rather than creating more semiconductor academies. However, with de-globalization already underway, companies like TSMC are expanding operations in the U.S., Japan, and Germany to meet customer demands. Its recent announcement for an additional US$100 billion further exacerbates the global talent gap.

This article is a collaboration between TechSoda and SemiVision. We offer the latest developments in semiconductor companies’ talent recruitment plans and insights for students who aspire to make an impact in the industry.

The Widening Talent Gap

A 2024 McKinsey report highlights the widening gap between supply and demand in the semiconductor industry. Only 1,500 engineers enter the field annually in the U.S., making up just 3% of engineering graduates. By 2029, demand for semiconductor engineers is projected to reach 88,000, far exceeding the current supply. Similarly, only 1,000 new technicians join the workforce each year, while demand for these roles is expected to rise to 75,000 by 2029.

The demand for skilled professionals spans the entire semiconductor supply chain—from IC design and manufacturing to packaging and testing. Companies are seeking engineers capable of advancing technologies for AI chips and IoT devices while optimizing power efficiency and computational speed. Beyond hardware expertise, software optimization is increasingly critical.

Multinational corporations like ASML, Applied Materials, KLA, and Tokyo Electron also compete for top talent by offering attractive benefits and salaries. ASML has expanded its workforce in South Korea and Taiwan while growing its U.S. operations to meet local customer needs. Similarly, Tokyo Electron announced plans to invest JYP1.5 trillion (about US$10 billion) in R&D over five years and recruit 10,000 employees globally.

Taiwanese companies are ramping up hiring efforts to address these challenges:

TSMC plans to recruit 8,000 employees in 2025, up from 6,000 last year.

ASE, TSMC's largest OSAT partner, aims to hire over 1,000 workers.

UMC markets itself as a globalized employer offering opportunities across multiple countries.

At recent campus recruitment events in Hsinchu, companies aggressively competed for new graduates' attention. Some companies offered lucky draws of prizes valued at more than NT$10,000 (around US$330) for students who submit resumes to them.

Chip companies are especially keen on developing new sources of talent, such as women, veterans, or vocational schools. TSMC even produced a video interviewing some of their female engineers to encourage young women to join them.

TSMC has been hosting Women in STEM events in Taiwan, with female executives and engineers sharing their experiences with university girls and inviting them to get to know the company and the work.

UMC, on the other hand, claims that 41% of its staff are women, higher than TSMC’s 34% and MediaTek’s 20%. UMC emphasizes that they welcome women applicants from all kinds of academic backgrounds, not limited to STEM disciplines.

Besides TSMC, other chip companies have already been cooperating with top universities in Taiwan, the US, Japan, and Germany to train future semiconductor engineers and technicians. Students from those programs often get scholarships and internships, which serve as tickets to formal job offers before getting out of school.

However, it takes at least 8 years (3 years of senior high school, 5-6 years in universities, and graduate school) for a student to accumulate sufficient knowledge in physics, chemistry, machinery, or electrical engineering to be able to cope with daily work in the semiconductor industry. Hence, the demands for talent always outpace supply, even before the geopolitical incidents that drove many countries to build chips locally. Not to mention, most STEM majors may still choose to work for AI companies or internet conglomerates after they graduate instead of joining the semiconductor industry.

The semiconductor industry faces a critical talent shortage, with demand for skilled engineers and technicians far outpacing supply. While AI and automation are increasingly seen as tools to alleviate this crisis, their impact is nuanced and limited by the complexity of semiconductor manufacturing.

Can AI address talent shortage problems?

AI has already demonstrated its value in areas like integrated circuit (IC) design and material exploration. By automating repetitive tasks and optimizing processes, AI reduces the workload on engineers, enabling them to focus on innovation and strategic decision-making. For example, AI-driven tools can accelerate chip design timelines and improve material discovery, helping companies stay competitive in a fast-paced industry.

However, the foundry sector remains too complex for full automation. Edy Tang, co-founder of SemiVision and a former engineer at UMC and TSMC, explains that foundry operations involve unpredictable challenges that require immediate human intervention to avoid costly production halts. "One piece of wafer costs $20,000, and stopping a production line could damage an entire batch worth $500,000," Tang notes. This high-stakes environment demands meticulous attention to detail and quick problem-solving skills, which are difficult to replicate with AI alone.

Tang also highlights the importance of hands-on experience in semiconductor manufacturing. While new engineers may possess theoretical knowledge, they rely heavily on senior colleagues for training. This mentor-apprentice system is a cornerstone of TSMC’s culture, emphasizing the human element in skill development.

Yet AI does excel in knowledge management by preserving institutional expertise amid high personnel turnover rates. It can also enhance workforce efficiency through predictive maintenance, defect detection, and process optimization. For instance, AI-powered systems can identify defects that traditional methods might miss, improving yield rates and reducing waste. Additionally, AI tools enable technicians to perform more complex tasks by providing real-time guidance and diagnostics.

Skill Requirements in Semiconductor Careers

Despite automation advancements, human expertise remains indispensable. At TSMC, engineers must analyze wafer data across multiple batches for statistical process control—a task requiring proficiency in Excel and even coding with Visual Basic for Applications (VBA). Tang said systematic management and interpersonal communication skills are equally critical for success in this demanding field.

Former TSMC engineer TJ emphasizes the importance of adaptability: "Maintaining a proactive attitude while handling shift work and overtime is essential. Work-life balance is something you must strive for with better time management and efficiency, and not something you are entitled to, if you want a career rather than just a job."

For those aspiring to excel in this field, pursuing advanced degrees can open doors to research roles focused on developing new process technologies or enhancing existing ones. “With a Ph.D. degree, it will save you time climbing up the company ladder,” said Tang. Of course, some people did their Ph.D. studies while working at semiconductor companies.

For people who wonder why TSMC chairman C. C. Wei said the R&D Center to be built in Arizona is not the same as the 10,000-strong R&D team in Taiwan, here’s the explanation by SemiVision:

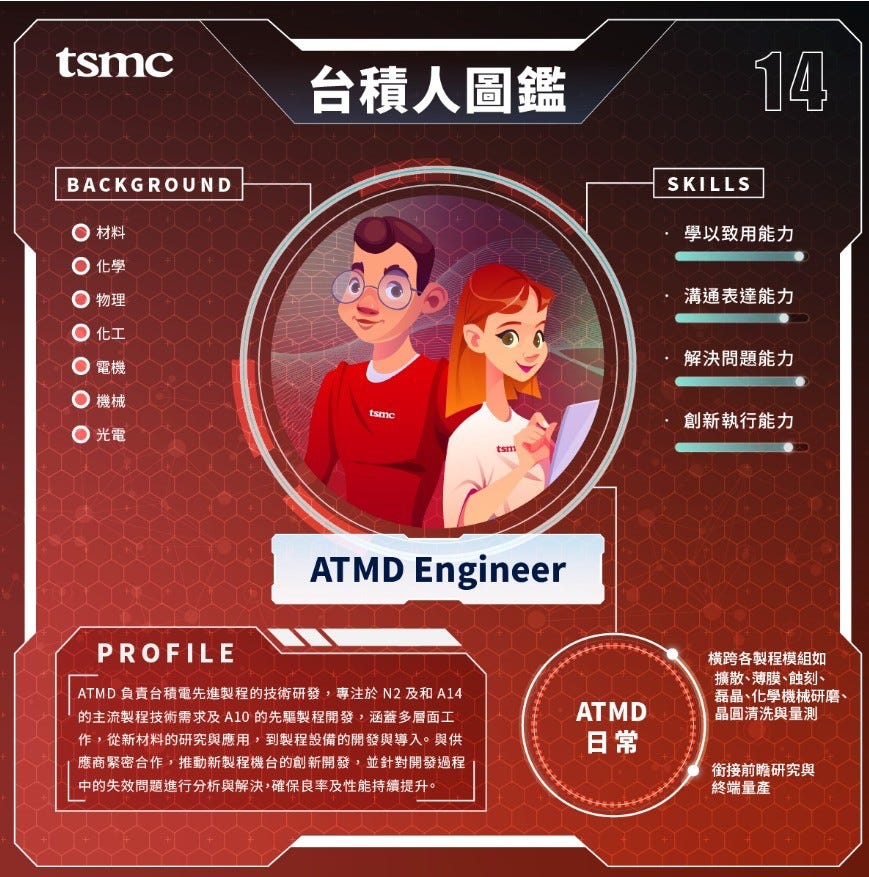

There are two main units within TSMC's front-line process research and development (R&D) division: Advanced Technology Module Development (ATMD) and R&D Process Center (RDPC). ATMD is upstream, responsible for designing and developing new process recipes, while RDPC is downstream, focused on testing and implementing those recipes on a pilot production line. ATMD engineers must balance theoretical knowledge with the practical demands of process integration, often pushing the limits of physics to meet performance goals. RDPC engineers, on the other hand, are responsible for maintaining the stability and control of their assigned equipment on the pilot line, monitoring for anomalies, and adjusting processes as needed to ensure consistent product quality. Collaboration and communication between ATMD and RDPC are critical for successful process development and for TSMC's ability to stay ahead of its competitors. In other words, the R&D center in Arizona will be an RDPC team, which will be conducive to maintaining consistent product quality and enhancing processes at Arizona fabs.

To address the talent shortage issue, Burn-Jeng Lin argues that the most crucial need in the semiconductor industry is educating students to become innovative talent who possess the creativity, observational skills, and problem-solving abilities to thrive in a rapidly evolving field (the perfect description for TSMC’s ATMD engineers?). Lin believes that fresh ideas and innovative approaches are essential for tackling challenges and driving progress, both within companies and across the industry as a whole.

Lin is the patent holder of immersion lithography. He became dean of National Tsing-Hua University’s College of Semiconductor Research after retiring from TSMC, as he sees the urgent need to bridge the talent gap.

On many occasions, Lin emphasizes that the rapid iteration of semiconductor technologies demands fresh ideas, innovative approaches, and new methods to solve problems and create opportunities, whether for companies or for the world at large.

TechSoda’s top 5 articles with the highest impressions

TSMC Faces Tough Choices Amid Rumors for Intel Collaboration

DeepSeek’s Rise: Why Microsoft and Nvidia Are Backing It Despite National Security Concerns

NVIDIA’s 2025 CES Keynote: Are We Witnessing the Dawn of a New Era?

A Deep Dive in How TSMC Won Its Place in Global Semiconductor Industry

Deep Dive: Is TSMC's $100b Investment Signalling A US Chip Revival?

Good topic 👍

While the U.S. Software Companies continue to maintain their interest in the “Attention Economy” due to its high margins, low headcount to revenue, addictive nature, zero sum gains to the economy and lucrative salaries for the talent in their mid 20s who are setting up their careers and appetites for financial rewards for life, it will be very difficult for a silicon fabrication human capital pool to develop. This again is as economic structural problem not an industry specific micro problem.

The “Attention” Economy with its focus on gamification and dopamine based engineering outcomes is attractive to work on, pays well and emotionally is “fun” and continues to build at scale financially attractive cash flows.

Fix the dopamine addiction and maybe in 20 years people will seek missions and jobs in boring semiconductors. Self inflected problem by market dynamics.